02/01/15 . . . by Bob Karrow

- If you aren’t familiar with my unorthodox wave counting method, there is a simple explanation at the beginning of the glossary. The glossary also contains lots of other details (explanations) that don’t appear in the blog.

- My charts consist of various indicators and index charts (short to long term), but the theme is concentrated on the items that Paul Desmond warned about in his paper, “The Warning Signs Of Major Market Tops”, which you can find at the link below.

- Please follow MY CHARTS if you’re a StockCharts subscriber so I’m not relegated to the dung heap of nobody is interested in my crap. You only have to follow once. You click the blue icon seen in the upper right of each page that says “Follow”. After you’ve clicked once, the blue icon should change to “Unfollow”. Leave it so it says “Unfollow”.

- If you want to know what I’m currently thinking (rantings on occasion too)

- A lot of visitors to my blog are looking for information on T-Theory ®. The below link will take you to the index of all of Terry Laundry’s comments during the period Dec 2003 to June 2011. There is a considerable amount of charts and audio material from Terry Laundry in this section.

- If you are looking for the ability to make your own predictions using T-THEORY ®, I would highly recommend Terry’s Encyclopedia on T-THEORY ®

- Order the T Theory® Encyclopedia from Paula

EDSON GOULD

—————————————————

If you haven’t been following my Tweets, take a look at what you’ve missed.

I’m not updating the blog anymore because it’s takes too much time to write, so I Tweet short messages instead.

I hope the charts come through on this blog update. They probably will because Twitter is hosting them and I see them on the blog “Preview”.

—————————————————

Technical Analysis Investing Trading Dec low (17,067.59) violated during 1st quarter, watch out! by Lucien Hooper pic.twitter.com/yCChMBNus8

Technical Analysis Investing Trading Market declines either end with a BANG or a whimper. A waterfall is a bang and they can fall too far

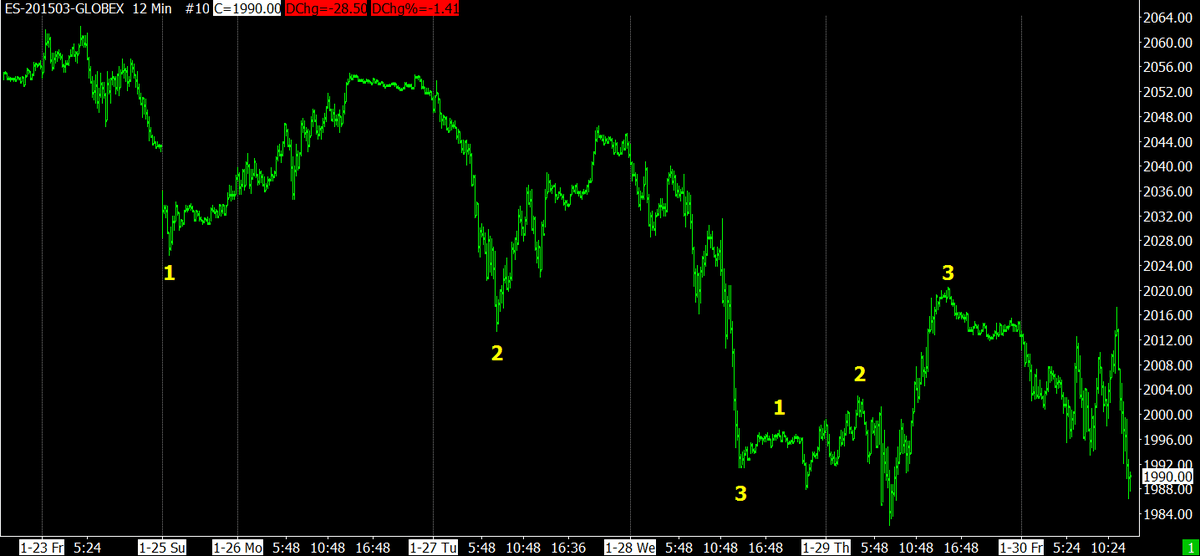

Technical Analysis Investing Trading From 3 up, I count 5 steps down, which raises fair possibility of double bottom pic.twitter.com/oAOVr7kysy

Technical Analysis Investing Trading Have to wait to see how this saga ends, double bottom or waterfall. Ugly chart pic.twitter.com/tBG6SvXTr6

Technical Analysis Investing Trading “The Raging ‘Currency Wars’ Across Europe” safehaven.com/article/36528/…

Scary headline, interesting article

Technical Analysis Investing Trading 17.6 yr cycle,

dates interesting, 2000 – 2018 has been my projection for years pic.twitter.com/1lAQIiaHUC

Technical Analysis Investing Trading Interesting, never know how true these things are but it makes me stop & think pic.twitter.com/BrXWSe7lWl

Technical Analysis Investing Trading Simple tool that would have you exit market & stay out at 3AM EST last night pic.twitter.com/tg1EKF9A0F

Technical Analysis Investing Trading Yen providing no comfort & might pull US market down. Is yen decline finished? pic.twitter.com/zVIz4zyquE

Technical Analysis Investing Trading A scary count of yesterday’s rally. Bearish if true. Can’t discount possibility pic.twitter.com/janyDpEtxg

Technical Analysis Investing Trading I want to see significant break of yesterday’s peak before the all clear sounds pic.twitter.com/iZ0tYUl6Vm

Technical Analysis Investing Trading A deep correction last night and this morning should be bottoming process, but? pic.twitter.com/SchXrRRJsR

Technical Analysis Investing Trading Until proven otherwise, I’m watching for a rally in bull market, but that attitude can quickly change

Technical Analysis Investing & Trading If we decline SIGNIFICANTLY past yesterday’s low, it will be a bad situation of 4th & 5th step down

Technical Analysis Investing & Trading Hopefully yesterday’s Put buyers established position near close & sold them after GDP announcement

Technical Analysis Investing & Trading We’ll see if most of last night’s slide in the ES futures had already baked in the disappointing GDP

Technical Analysis Investing & Trading Futures are presently near a Fibonacci retracement of 62%. We’ll see if that holds.

Technical Analysis Investing & Trading Only 2 obvious steps up today, but I will call the step complete for now. Next up is . . .

Stock Market Technical Analysis Investing or Trading Wave counting is sticky in extended moves in bull/bear markets. Short swings are easy

#StockMarket #Stocks #Investing #Trading After 3rd step up, correction, or on to 5 steps up. 5 good steps would look good for recovery move

#StockMarket #Stocks #Investing #Trading Today’s rally didn’t break downtrend channel from it’s recent peak. 2 steps up from today’s low.

#StockMarket #Stocks #Investing #Trading GDP revision tomorrow, was reported 5.0% in 4th quarter, consensus says it’s revised down to 3.2%?

#StockMarket #Stocks #Investing #Trading I have called no peaks/tops on Twitter, because I am waiting for an important top to complete.

#StockMarket #Stocks #Trading Have called correctly bottoms 12/16/14, 1/6/15 and 1/29/15. Early & wrong on 1/16/15 pic.twitter.com/TQOnN8FO1V

#StockMarket #Stocks #Investing #Trading Today’s wave count. pic.twitter.com/BXIAEec1yc

#StockMarket #Stocks #Investing #Trading Lots more puts bought than calls. Some don’t believe that was a bottom pic.twitter.com/Pb6myMlpXy

#StockMarket #Stocks #Investing #Trading Have an appointment, gotta go for now. Stops are in for me.

#StockMarket #Stocks Sometimes you don’t see the real rally until step 3, other times nothing really good happens pic.twitter.com/kb5Z6T1ZGp

#StockMarket #Stocks #Investing #Trading Recent trend in the #Yen, propelling our market upward pic.twitter.com/DUxs7Dwzx1

#StockMarket #Stocks #Investing #Trading Touched this line and retreated for now. pic.twitter.com/OGwxWtkvmJ

#StockMarket #Stocks #Investing #Trading Broke #Fibonacci line, which should provide fuzzy support now. We’ll see pic.twitter.com/vDqr2LvFBw

#StockMarket #Stocks #Investing #Trading Breakout and needs to break #Fibonacci line too. pic.twitter.com/dzQhNn7nbm

#StockMarket #Stocks #Investing #Trading Small but labored break of prior high pic.twitter.com/pi2FCCAE5R

#StockMarket #Stocks #Investing #Trading See link for more info on my wave count technique. Blog not updated now. stock-market-observations.com/category/3-rea…

#StockMarket #Stocks #Investing #Trading Don’t use Elliott Wave. I use channel breaks as the final say on wave count pic.twitter.com/2qGM0v9Cuz

#StockMarket #Stocks #Investing #Trading Getting perspective. Longer wave count showing step 3 since March 2009. pic.twitter.com/XzL2G6cr2r

#StockMarket #Stocks #Investing #Trading If low on 12/16/14 is broken, then lower lows will be in effect. Bearish pic.twitter.com/72uKUau9xp

#StockMarket #Stocks #Investing #Trading Waiting for step 3 in much larger step 5 makes me not a BIG bear. pic.twitter.com/jrl5GfFSwL

#StockMarket #Stocks #Investing #Trading FOR NOW, I’ll go with this count. But a lower low switches to other count pic.twitter.com/g5UxHat0i4

#StockMarket #Stocks #Investing #Trading If this wave count is correct, it is undermined how bearish it might be pic.twitter.com/WiDyNcLLkg

#StockMarket #Stocks #Investing #Trading Another wave count for large step 3 down. Higher highs will determine count pic.twitter.com/zR3rvLGy1w

#StockMarket #Stocks #Investing #Trading A step count for larger step 3 down. Stopped on #Fibonacci line presently pic.twitter.com/1XlVE27y2c

#StockMarket #Stocks #Investing #Trading Is step 3 over, has 5 steps down. Now waiting for higher highs to validate pic.twitter.com/kboqGBYpWE

#StockMarket #Stocks #Investing #Trading SPX wave count on downside since 12/29/14 peak. Question, is step 3 over?? pic.twitter.com/icBOk7G6kp

#StockMarket #Stocks #Investing #Trading Thinking step 4 down was decline after step 1 up. In step 2 up presently. Job report was leaked??

#StockMarket #Stocks #Investing #Trading Apple mystique could prevail for a long time. I’m a member of Apple’s unthinking Borg collective

#StockMarket #Stocks #Investing #Trading iPhone falls out of favor, Apple profits crash. Apple’s cash enough give everybody in USA $540

#StockMarket #Stocks #Investing #Trading 69% of Apple’s profit is from iPhone. Apple has turned into a one product company. Dangerous??

#StockMarket #Stocks #Investing Job report increasing recently, bad weather doesn’t raise hopes, good report unexpected & be rally fuel

@Stock_Trend_Chg: #StockMarket #Stocks #Investing #Trading #Futuresare set to rally if jobs report is good, or decline into 5th step down.

#StockMarket #Stocks #Investing #Trading Tonight #SP500 #futures broke the lows made near today’s close. Looks like 4th step down of 5

#StockMarket #Stocks #Investing #Trading See my inflation/deflation charts at stockcharts.com/public/1169350… pic.twitpic.twitter.com/2Odt2D990c

#StockMarket #Stocks #Investing #Trading Duhhhhhh . . . why do we have such absurdly low long term interest rates? Because deflation lurks.

#StockMarket #Stocks #Investing #Trading FED previously described the commodity price drop as “transitory”. Apparently, not anymore.

#StockMarket #Stocks #Investing #Trading Finally someone is talking about deflation, namely the FED, saying inflation is too low.

#StockMarket #Stocks #Investing #Trading Looks like the jobs report tomorrow will tell the tale. pic.twitter.com/lXjxRVC1HQ

#StockMarket #Stocks #Investing #Trading Breaking prior lows & shaking tree to see who falls out. Waterfall here pic.twitter.com/L7vaH0wmWN

#StockMarket #Stocks #Investing #Trading Short term #Fibonacci lines pic.twitpic.twitter.com/zLZMFj9Nc4

#StockMarket #Stocks #Investing #Trading If market penetrates earlier lows & gains momentum, step aside, but if it wanders around – wait

#StockMarket #Stocks #Investing #Trading FED announcements cause schizophrenic trading for 10-30 minutes & then the direction is normalized

#StockMarket #Stocks #Investing #Trading Relative strength on Nasdaq currently, but is it enough to not break low pic.twitpic.twitpic.twitter.com/LLJDtjnyH3

#StockMarket #Stocks #Investing #Trading Watch for #Fibonacci break on current line, breaks diamond too. pic.twitter.com/9zuvVN5qkz

#StockMarket #Stocks #Investing #Trading Watch diamond, 3 steps down & should rally, or continue down with 5 steps pic.twitter.com/Qt95pCwWtl

#StockMarket #Stocks #Investing #Trading We didn’t break the diamond formation that I showed yesterday on this morning’s down thrust.

#StockMarket #Stocks #Investing #Trading 3 steps down & rally. #Fibonacciretracement lines & Fibonacci ray lines too pic.twitter.com/580pzaPNwA

#StockMarket #Stocks #Investing #Trading Diamond occurs at top of long uptrends. Signals retracements with accuracy? pic.twitter.com/hfr6dcrMSR

#StockMarket #Stocks #Investing #Trading Does that vaguely look like a diamond formation? Waiting for breakout pic.twitter.com/UDlMQ36r5y

#StockMarket #Stocks #Investing #Trading Summation index has lower highs since July, while #SP500 made new highs pic.twitter.com/osy2SjZEtd

#StockMarket #Stocks #Investing #Trading Notice % over 200 day MA has shrunk slowly since July 2014 (Mid cap & SPX) pic.twitpic.twitter.com/kW37YTHbw7

#StockMarket #Stocks #Investing #Trading GOLD ETF since 2002 plus #Fibonacci lines pic.twitter.com/eccx15Ayb0

#StockMarket #Stocks #Investing #Trading Chart of VIX since late 2006. Look carefully at some of the early warnings pic.twitter.com/SXxn2mIGMl

#StockMarket #Stocks #Investing #Trading #Fibonacci fan lines from the late 2002 bottom. It appears to be valid pic.twitter.com/rt6kCouhUB

#StockMarket #Stocks #Investing #Trading Informational chart showing DJIA monthly from 1902 to the present. pic.twitter.com/HkPwHh3yt6

#StockMarket #Stocks #Investing #Trading DJ Ind gapped down tonight & is presently down about 120 points (Greece) pic.twitter.com/IMW2xlh5A0

#StockMarket #Stocks #Investing #Trading Greece Effect Tonight – not too bad #Dax is down .74% #FTSE is down .6% #Euro is down .26%

#StockMarket #Stocks #Investing #Trading Long term #fibonacci lines beginning in 1982 pic.twitter.com/sgt5naq8FF

#StockMarket #Stocks #Investing #Trading Long term #fibonacci lines from 2002 bottom pic.twitter.com/CNkwwVHTp1

#StockMarket #Stocks #Investing #Trading DJ Transports projected peak from head and shoulders formation from 2009 pic.twitter.com/zw3yHvZUOu

#StockMarket #Stocks #Investing #Trading #Fibonacci lines for micro cap stocks since Mar 2009 bottom pic.twitter.com/4h5nZI8scq

#StockMarket #Stocks #Investing #Trading Small cap stocks (RUT) in the last step up in this phase of the bull market pic.twitter.com/Y5AJpil9kX

#StockMarket #Stocks #Investing #Trading Two pitchforks defining step 3 up since Oct 2011 pic.twitpic.twitter.com/xrgHhSIAd1

#StockMarket #Stocks #Investing #Trading Step 3 will be finished when the blue line is significantly penetrated pic.twitter.com/hcgrZo2leI

#StockMarket #Stocks #Investing #Trading One possible wave count for step 3, which began in Oct 2011 pic.twitter.com/pgPY3XHJid

#StockMarket #Stocks #Investing #Fibonacci lines at work tonight providing some support pic.twitter.com/nwxzfDr3Wd

#StockMarket #Stocks #Investing Interesting study on weekly #JoblessClaims versus the #SP500pic.twitpic.twitpic.twitpic.twitter.com/JQUxWxQy1R

#StockMarket #Stocks #Investing What effect will Greek elections have on Euro stock markets? Greece now wants debt write-off. Not likely

#StockMarket #Stocks #Investing I see 3 steps down in #London since June 2014 giving validation to current rally. pic.twitter.com/2sMAgEVyFp

#StockMarket #Stocks #Investing #London is close to a break out. London “can” be a future indicator of US markets pic.twitter.com/TQqbT5KQig

#StockMarket #Stocks #Investing Financials are 16% of the S&P 500 & energy 9%. 25% of SP is under pressure & will have reduced 2015 earnings

#StockMarket #Stocks #Investing Germany is at new highs & London is behind & must break through overhead resistance pic.twitter.com/I3o9szOlNn

On Jan 20 tweeted Looks like a small 3 step down today. A rally failure here means 5 down instead of 3 Obviously we never had rally failure

When I say 3 steps down are finished, I’m saying a rally is next. Tweet limitations don’t allow me to say that every time, so it’s inferred

#StockMarket #Stocks #Investing Slow deterioration of stocks over their 200 day moving average as SP500 moves higher pic.twitter.com/TJzqez9593

#StockMarket #Stocks #Investing Markets are working into a good buy spot, but the buy spot does not arrive until Feb or Mar – Jeff Saut

#StockMarket #Stocks #Investing #NASDAQ #pitchfork looks valid & has provided support & resistance since 2009 pic.twitter.com/MUJmOdx5pK

#StockMarket #Stocks #Investing Looks like a small 3 step down today. A rally failure here means 5 down instead of 3 pic.twitter.com/6ynDO9o5fH

#StockMarket #Stocks #Investing Valid #fibonacci trend lines from 2009. Has had predictive value in the past. pic.twitter.com/MTG4kRC8zF

#StockMarket #Stocks #Investing A crude timing #cycle for #JunkBonds(JNK). Is it still relevant??? pic.twitter.com/jgaTVLDa16

#StockMarket #Stocks #Investing Is this #pitchfork valid? A rebound at the moment, but providing further support? pic.twitter.com/m0XwhsOzD5

#StockMarket #Stocks #Investing But watch out for that double bottom in the #SP500. Stay alert as usual.

#StockMarket #Stocks #Investing #Yen warning with lower high on 12/29 We may be in a correction . . . 10% or so, but pic.twitpic.twitter.com/Gs6oyyUBIv

#StockMarket #Stocks #Investing #Fibonacci trend lines since the Oct 2011 bottom Possible #WaveCount since Mar 2009 pic.twitter.com/XsFyFcdual

#StockMarket #Stocks #Investing Since 2009, two different trend lines for step 3 (of 3) pic.twitpic.twitter.com/WZhnRYfVrY

#StockMarket #Stocks #Investing Lately the #Yen hasn’t been pulling the #SP500 into an uptrend. pic.twitpic.twitter.com/Qn80RJdHqB

#StockMarket “An All-Time 1st?: Swiss Market Index Goes From 52-Week High To 52-Week Low In Same Week” – Dana Lyons pic.twitter.com/aT4yjiaFbc

#StockMarket #Stocks #Investing Market is oversold & seasonally the period of weakness . . . should end some time next week – Mike Burke

The Dow Ind & Tran have small lower highs & lows. You can see in the 1st chart on link below. Lots of charts belowstockcharts.com/public/1169350…

#StockMarket #Stocks #Investing One possible wave count since 2009. We have no idea how long step 3 (cyan) will last pic.twitter.com/v9ytOyVaWw

#StockMarket #Stocks #Investing Bank stocks are sick pic.twitter.com/WSDrdhdggB

#StockMarket #Stocks #Investing Large caps made insignifcant lows, smaller caps performed better. We’ll see later pic.twitpic.twitpic.twitpic.twitter.com/gMPNOohVbm

#StockMarket #Stocks #Investing Updated #Fibonacci lines for latest two significant declines pic.twitter.com/5BhYxDHgsC

#StockMarket #Stocks #Investing Another version of the latest #Fibonaccichart pic.twitter.com/tBXIvbBFlU

#StockMarket #Stocks #Investing Updated #Fibonacci chart including the most recent decline pic.twitter.com/OFDxj214Hd

#StockMarket #Stocks #Investing See chart for next #Fibonacci ray for support, around 1970 on ES futures pic.twitter.com/uzxViBdJrv

#StockMarket #Stocks #Investing Jeff Saut is standing aside for the 1st quarter 2015 or until market accomplishes his downside goals (-10%)

#StockMarket #Stocks #Investing Moving envelope shows downside liability for the moment, for short term use only pic.twitpic.twitpic.twitpic.twitter.com/NUS7eH9buG

#StockMarket #Stocks #Investing Moving avg reveals character of market, not big on moving avg, they have their use pic.twitter.com/guT2OHSqtR

#StockMarket #Stocks #Investing Fibonacci downtrend is STILL active, shouldn’t be true if in rally mode since 1/6/15 pic.twitter.com/Y2pbxpXWlU

#StockMarket #Stocks #Investing #SP500 1. Rally from prior low OR 2. 4th step penetrates prior low and waterfalls pic.twitter.com/YbgsYgA2A3

#StockMarket #Stocks #Investing 3rd step down in #SP500, very close to prior low on 1//6/15 pic.twitter.com/r05rHLimSt

#StockMarket #Stocks #Investing Banks are weaker than the rest of the market. That’s never good. pic.twitter.com/KxiG4qj46Y

#StockMarket #Stocks #Investing Junk shows 3 lg steps down, a sm rally followed by a lower high, still INDETERMINATE pic.twitter.com/YNWZexRl3x

I may not be connected to the market for the rest of the week. It’s kinda iffy. If I post, great & if not . . . curses . . . foiled again.

#StockMarket #Stocks #Investing Hmmmm. ES contract was down 44 points in 4 hours (top to bottom).

#StockMarket #Stocks #Investing Market is sub-dividing to downside. Need to re-evaluate count, but presently not connected to market feed.

@focus1234567 trend is up

#StockMarket #Stocks #Investing Yesterday I said “Here we go on the upside after a higher low with a 3 count down” ANOTHER LOW CALLED RIGHT

#StockMarket #Stocks #Investing Here we go on the upside after a higher low with a 3 count down. pic.twitter.com/G1yUTY1zDh

One of the BEST strategists – “weight of evidence suggests the bull market has embarked on a broad topping process that could take its time”

#StockMarket #Stocks #Investing That looks interesting, but we have to see higher highs and lows. pic.twitter.com/Rf7WtiJj0o

#StockMarket #Stocks #Investing “Saudi Prince: Oil will never return to $100” That’s true if they want to keep #shale #oil out of business

#StockMarket #Stocks #Investing Another view of Fibonacci at work. pic.twitter.com/8zesYTVXre

#StockMarket #Stocks #Investing Fibonacci line is “trying” to hold market here. Looks like 4th step down (of 5 down) pic.twitter.com/7FkMxZp07I

Sometimes divorce can be very very expensive. I wondered how you could write all that on a small check . . . 2 lines pic.twitter.com/t6RWjSRLD5

#StockMarket #Stocks #Investing Seasonality: Next week has not been up for over 20 years. – #MikeBurke That says it all except how much???

#StockMarket #Stocks #Investing We’ll see how things go next week. Be watching SP500 futures on Sunday to see if they give any direction

#StockMarket #Stocks #Investing Downtick in “Small Business Lending Index” pic.twitter.com/u0OzCtFdwW

#StockMarket #Stocks #Investing As suspected – since the high made after the jobs report, we have been in a corrrection

#StockMarket #Stocks #Investing Higher high turned out to be a whipsaw and failure pic.twitter.com/EHFmfYkcJ4

#StockMarket #Stocks #Investing Small triangle just broke to the upside, we’ll see if it breaks prior high pic.twitter.com/WDcMhNhHY1

#StockMarket #Stocks #Investing Small triangle forming today, watch which way it breaks out pic.twitter.com/ESPDbYI3Cy

#StockMarket #Stocks #Investing Does this #Fibonacci line mean the decline it’s based on is still alive??? pic.twitter.com/urDNM68nDt

#StockMarket #Stocks #Investing Another #Fibonacci chart, targeted peak on Thursday & approx on Friday pic.twitter.com/8iRJPNJ2S1

No #shale #oil means no #fracking, which means no protests about fracking dangers plus the fracking #earthquakes will eventually subside

Only way to eliminate shale oil is keep prices permanently low. That’s a steep price for OPEC to pay to get rid of shale oil.

Low oil prices “can” eliminate shale oil, BUT when prices rise, shale oil comes right back on the market. Shale is like money in the bank

#StockMarket #StockCharts #Investing Note how the #Fibonacci line targeted the rally peak perfectly pic.twitter.com/lIsmKZMgWA

#StockMarket #StockCharts #Investing I’m waiting for a higher high and above a green line before buying again. pic.twitter.com/5T6dnJb76l

Market didn’t perform right after jobs report, rallied, small decline & failed to make new high, I sold my ES futures pic.twitter.com/lhVzsjbLBM

#Bond #Investing Has #shale #oil #junk #bonds default been factored into price of junk bond ETFs – I don’t think so pic.twitpic.twitter.com/AKhP5MigoH

#StockMarket #StockCharts #Investing #Bond #investors who helped finance America’s #shale boom are facing potential losses of $11.6 billion

#StockMarket #StockCharts #Investing “The $173 billion in U.S. energy junk bonds make up the biggest portion of the high-yield debt market”

#StockMarket #StockCharts One could interpret the chart as a #sawtoothed #top? More of the same makes it true pic.twitter.com/fF7GMr4HOd

#StockMarket #Investor #TrendLines #StockCharts Small caps – 18 months. Mar thru Oct looks like one large correction pic.twitter.com/k4OiLOgHVs

#StockMarket #Investor #TrendLines #StockCharts I might get concerned on the next top because that will be the 3rd top since the Oct bottom

#StockMarket #Investor #TrendLines #StockCharts On our way back to the old highs. Slightly past the 62% retracement pic.twitter.com/Ys694QE2wd

#StockMarket #Investor #TrendLines #StockCharts Reason dollar is rising is that every other currency in the world is falling – John Murphy

#StockMarket #Investor #TrendLines #StockCharts Small caps are performing very well since their bottom on Tuesday pic.twitter.com/StTuEVaECy

#StockMarket #Investors 22 hours ago on Tuesday 1/6/15 I nailed another stock market low. Did the same on Dec 16th too.

#StockMarket #Investors Yesterday I said: “looking for higher highs & higher lows because . . . we’re going to rally” pic.twitter.com/7ZjUwomZWW

#StockMarket #Investors Red trendline has multiple support points & could be a reversal area for the present decline pic.twitter.com/D5HeVHSGug

#StockMarket #Investors Long term #fibonacci lines and wave 3 possible peak pic.twitter.com/B5b6R07HRn

#StockMarket #Investors #Fibonacci lines & count for downtrend. Higher highs above 2017 #SPX could signal reversal pic.twitter.com/S9Z0w35QrK

I would think we would have 1 more peak before anything disastrous took place. Sometimes the best laid plans go awry pic.twitter.com/kpwJ9DL0W5

We could be in rally mode. This rally should be tradable. pic.twitter.com/yu5iSvW6wq

Pay attention to market. Right now I’m looking for higher highs and higher lows because I think we’re going to rally.

“Downside surprises on #inflation are far from over. That’s probably going to be the very important theme for the year.” – #DEFLATION

The out of control price decline in #oil could cause a #FinancialAccident. If the accident is big enough, it could be CONTAGIOUS

#StockMarket #Investors How the count looks in the market. It’s going for 5 thrust channels down and we’re in 4. pic.twitter.com/e1j4y0Nsnn

#StockMarket #Investors Yesterday I said: “Finished last step down . . . it’s rally time” I couldn’t have been more wrong.

#StockMarket #Investors Well . . . the #yen WAS going in the right direction for a rally pic.twitter.com/OWlkOMq3ii

#StockMarket #Investors #Yen is going in the right direction for a stock market #rally pic.twitter.com/CvplXiPiYR

#StockMarket #Investors Finished last step down & that means it’s rally time. It’s a slow start just like last time pic.twitter.com/I7RLxMsqyd

#StockMarket #Investors The next 6 months are, by far, the strongest 6 month period in the 4 year Presidential Cycle – by Mike Burke

#StockMarket #Investors See my charts from #StockCharts at the link below stockcharts.com/public/1169350

#StockMarket #Investors 3rd chart, #NASDAQ is turning up. 1st chart #SP500, 2nd chart #DowJones #Industrialspic.twitpic.twitpic.twitter.com/LnvmiAodbt

On 12/31 wrote #StockMarket #Investors I think . . . most of the step is probably behind us Today had bottom signs pic.twitter.com/TNZ8I2qwXq

Lobbyists . . . the bane of government decisions. Cartoon shows lobbyists are hard at work for the banks. pic.twitter.com/USN2GPwXRJ

I’m a believer in Glass Steagall legislation. 2008 gov’t bailouts teach banks they are invulnerable & needn’t worry pic.twitter.com/J8Tyd9COYe

Cartoon is showing that “History always repeats, only the details change” pic.twitter.com/6N4wK7Xsid

That’s all my charts and comments for now. youtube.com/watch?v=gBzJGc…

Long term declining #trendline for Tokyo. pic.twitter.com/7O4IBKMcew

Chart of London #FTSE since 1998 with an upward wedge beginning in 2008 to the present. pic.twitter.com/zzUbhSdCaH

Value Line index since 1980 showing triple top, current pitchfork, and descending line for bottoms. pic.twitter.com/dRYRu8YD1U

Long term chart of #SP500 since 1980 with the wave count from 1982 to 2000. Large steps green III, IV & V are labeled pic.twitter.com/vzuEMPyzRH

Either a long consolidation pattern, or the epitome of a sawtooth top. pic.twitter.com/VpMr117Khk

#Russell2000 (#RUT) has a possible #headandshoulders formation with the neckline a little below present prices. pic.twitter.com/8MYrlyjbJp

#SP500 on bottom line of pitchfork. Breaking of this line “could” denote end of step 3 since Oct 2011 ??? pic.twitter.com/ngymzayzgw

Internals on utilities sector is not as weak as prices indicate. Strength ahead for utilities??? pic.twitter.com/dRB1eY3qcF

Internals on materials sector is much weaker than the price indicates. More weakness to come in materials??? pic.twitter.com/C2TKE7DEYS

But some investors are moving into money market funds showing a little fear. pic.twitter.com/6pJqdTOCM6

Chart shows what investors are doing with their money. They are still #Bullish and refuse to move to #Bears funds pic.twitter.com/XGaS6Gatme

GE is still leading the way down amongst the blue chips. pic.twitter.com/618pNTVZxB

Small caps are still leading the way down. I would expect this trend to reverse when we have a good bottom. pic.twitter.com/kwMV1qiWQh

New low without a new low in prices. Negative Divergence. pic.twitter.com/mFMaDYGwSb

#Stocks keep going below 200 day MA while having a tepid #rally. #Chart is percentages of stocks below MA in an index pic.twitter.com/Gv1N3EBJXH

High low difference got better today instead of following advance decline line down. My Charts stockcharts.com/public/1169350pic.twitter.com/2PLltWr7Nc

New lows in adv dec line today without price low in large caps. A negative divergence between adv dec line & prices pic.twitter.com/pVckTtddpG

“Futures on U.S. and Asian stock indexes fell after a slump in oil prices and the worst quarterly drop for global equities since 2012”

It is important to remember that all market cycles have two halves. streettalklive.com/index.php/blog… pic.twitter.com/kYptY0ftcn

We’re now exactly 1 month away from the Oct Fed meeting & end of QE3. Most saying it’s diff this time (from QE1/2)… pic.twitter.com/ckYbgWVFDs

My favorite reach for yield indicator under more pressure after Gross announcement, still much more to go IMO. $PHK pic.twitter.com/JUaXliJwG6

Absolutely stunning reversal in Brazil this month. 20% peak to trough decline. $EWZ pic.twitter.com/ojytf2ZDaf

perspective matters pic.twitter.com/hFKB00TSrl

We had a lower low in small & mid-cap indexes today. Could be showing we haven’t finished current & larger step down pic.twitter.com/VDOO89V56L

Be Aware and Be Cautious – until you know otherwise.

But if we break the decline’s lows, you’ll know step 3 down is underway (scenario 2). It could be a waterfall event. pic.twitter.com/eFvRseeVIe

We haven’t made new low since 9/25 (Thu). The rallies have been muted, but until step 3 up is finished, we are in rally mode. (continued)

2 scenarios likely. 1. We rally up to old highs 2. We have completed ONLY 2 steps down and will decline into 3rd step (continued)

Hmmmmm, I have this decline counted as 3 steps down (double bottom 3rd). No new lows since 9/25 (Thu). (continued) pic.twitter.com/veV5YGko8H

#history always repeats, only the details change – #EdsonGould Many Edson Gould’s #Anametrics #FindingsandForecasts articles are on my blog

NOT A GOOD TIME, BUT I MAY BE BUSY WITH OTHER THINGS FOR A COUPLE OF WEEKS I’ll try to tweet important stuff after each day’s market close

“it is worth mentioning that a stronger dollar is an effective tightening of monetary policy.” – Jeff Saut

Headline: “U.S. Stocks Drop Amid Hong Kong Protests”. Why would the #stockmarket decline because of Hong Kong. Bad reasoning for headline.

Look at difference between the wave count on SP500 futures (here) versus SP500 chart (actual index) in prior tweet. pic.twitter.com/rLwoPMP1oY

SP500 chart shows 4 steps down. The 4th step could be a double bottom. Failure on upside means 5th step coming. pic.twitter.com/20Y3dNP2Hd

“Might” be the end of step 3 down since 9/19. Higher highs needed for confirmation of step 3 ending. 5 down or worse? pic.twitter.com/53OpV0HetX

Since 9/19, large caps have 3 steps down & the small caps are missing a step. That means maybe one more step down of differing consequences

The history of the crash of 1929. The years leading up to 1929 and the stock market’s influence on the country youtube.com/watch?v=_YgzVt…

FED paper called “A Brief History of the 1987 Stock Market Crash with a Discussion of the Federal Reserve Response” wp.me/a1DRwF-32f

The two video clips posted of stock market crashes has NOTHING to do with the present I posted them because I like stock market history

Crash of 1987, news clips throughout the trading day of the largest percentage drop in the stock market since 1914. youtube.com/watch?v=UO-mD9…

Charts & audio from the pits for the Flash Crash of May 6 2010 Fun to listen to the emotional breakdown of narrator youtube.com/watch?v=njwf1F…

During QE3: US National Debt: $16 to $17.7 trill. Fed Balance Sheet: $2.8 to $4.5 trill. Both up $1.7 trill. pic.twitter.com/5bgwDnUpXm

Senator Elizabeth Warren called for congressional hearings into allegations that the FED has been too deferential to the firms it regulates.

9/27/14 – Mike Burke Seasonally there is often a bottom after the 1st week of October.

9/27/14 – Mike Burke New lows are all that matters When a bottom has been reached, new lows will diminish quickly No sign of that now.

9/27/14 – Mike Burke For the past 40 years average returns for the coming week have been negative by all measures.

Short sellers have a 12 million share position in Alibaba, a week after the company priced the world’s biggest-ever initial public offering.

Put in $25, Get $10,000 Back. Your Bank Becomes a Casino US banks of all sizes could start tempting savers with savings promotion raffles

Goldman Sachs is changing a policy addressing conflicts of interest to bar investment bankers from trading individual stocks and bonds.

Trend channel break will indicate that step 3 in larger step 3 (began in Oct 2011) is finished. Significant correction will then take place.

An alternate wave count for larger step 3. If true, this count indicates a return to old highs would take place. ???? pic.twitter.com/QQoetTSUmH

A long term wave count since 2009. The only question is whether larger step 3 is finished. pic.twitter.com/HfWTTlcN2F

Fibonacci lines in effect presently for the SP500 and a wave count pic.twitter.com/rMzkgfOkt2

Russell micro cap decline since July 1. Apparently finished step 2 down, it’s not conclusive with a trend break yet pic.twitter.com/uxUqslEtq9

That should conclude the decline that begin on Sept 19. Rally now to new highs? That’s the big question??? More later pic.twitter.com/fVQRi1vFik

Collusion between the FED & Wall St in “The Secret Goldman Sachs Tapes” Article bloombergview.com/articles/2014-… Audiothisamericanlife.org/radio-archives…

Majority opinion pic.twitter.com/qWkMLypCAA

.@TheCreditBubble has requested this cartoon from the Summer of 1987 pic.twitter.com/OhrdZVcXuq

No fear without a rise in assets of the bear funds or a rise in assets in money market funds. Both rise in bad times. pic.twitter.com/iVp0AMTD3B

The wave count since July Read about my wave count method at stock-market-observations.com/2011/07/02/odd… pic.twitter.com/zvp10ezq0w

If this cycle stays in gear, we should rally soon. The predicted low date is tomorrow, but it’s not unusual 2 B early pic.twitter.com/4iz4ZfXdPl

90% of total volume was declining today Declining stocks were 83% of the total traded Should bounce after an extreme day, if not, watch out

Sometimes it’s all about perspective pic.twitter.com/BK5TNHcRSd

How to make the stock market go up pic.twitter.com/Uljr5aCuNG

How to make the stock market go up pic.twitter.com/35YfsoF1Cf

Wall Street research materials pic.twitter.com/7cuARdKa2i

Mark Twain and his stock market advice of when to buy pic.twitter.com/UoTE5JZiTR

Which light is lit right now??? pic.twitter.com/L5PTG1wBMo

Is he on now??? pic.twitter.com/xfDgJWGjd5

How Wall Street operates pic.twitter.com/EHX76oT4Wi

The short term wave count & did we finish step 2? It’s possible. Notice the Fibonacci lines are providing resistance pic.twitter.com/LQpZBz5T7W

Jeff Saut has support at 1965 – 1970 for the SP 500. We bounced off that level today.

Was the decline ending in Aug step 1 down? Smaller caps show it was step 1 down. We started step 2 down Fri 9/19/14 pic.twitter.com/sgMwMUZFaM

The first step was Fri to Tue & we are in second step down of 3 steps. My method of wave counting can be read here: stock-market-observations.com/2011/07/02/odd…

Surprise, I woke up & saw the market had crashed, I hadn’t been stopped out, but was making money again. Lucky trade on a chancy wave count

Yesterday I counted a poor looking 5 steps up, so I went short again after the close with a stop above the high. My expectations were low.

60 minute envelope in a bottom area early this morn. Rallies usually take place when the index hits bottom envelope pic.twitter.com/8iJOthzhgi

SP 500 futures have recovered 38% of the decline, while the NASDAQ futures have recovered 61% of the decline. Lotsa strength in the NASDAQ.

Triangle formation in oil has been forming since 2011. Downside projection could be $65. That smacks of deflation pic.twitter.com/dg3aLTmEFo

The wave count since last Friday pic.twitter.com/uVRmB4yZQn

Looking at the percentages, small caps are doing better than the larger caps pic.twitter.com/wxW5e67jZF

We’re obviously breaking the downtrend that began last Friday. If we don’t make new highs, this decline becomes step 1 down (of 3 or 5).

@focus1234567 Show off

@focus1234567 Yeah I’m going to bed now & reading my Kindle until I fall asleep. I have a wrist lanyard to keep it from falling on the floor

@focus1234567 I’ve been tending in that direction for a couple of years. Jeff Saut says this bull market has years to run.

@focus1234567 makes a man healthy wealthy and wise. You’re getting up and I haven’t gone to bed yet.

@focus1234567 You ever sleep? Don’t say 2008, it scared the crap out of me the 1st time. But someday large 3rd step down will take place!

50 day moving average of the SP 500 is only about 5 points lower. Doesn’t mean much though.

$65 oil in a couple of years??? I’ll post the chart tomorrow that shows the possibility.

Shorter & longer term oscillators oversold. Only if in a serious decline would I expect the oscillators to go lower, otherwise rally soon.

ES futures look like 4 (of 5) steps, but a trend break is the deciding factor whether the complete step is finished pic.twitter.com/PA6u6wMWOf

Large caps have no steps down & if an intermediate term decline has begun, 3 steps down are coming. This matches the prior chart’s count.

The count in this chart shows 3 more steps down. 3 more steps down puts large caps in gear with this chart. (cont.) pic.twitter.com/kGXEU9OraQ

One of these days, the uptrend is going to end and stocks will slice right through oversold readings. Until then, the trend is your friend.

@focus1234567 I’m watching a small time frame decline (Fri to Tue), which could morph into a larger decline. If true, this is step 1 down.

NASDAQ has rallied off of their lows, while DJIA and SP 500 are on their lows of the day.

Market is breaking down and sub stepping into more steps down. I’ll update the count later in the day.

The indicator in the lower window indicates a rally should be expected. pic.twitter.com/5MWhz3I5GE

The NASDAQ Composite is one of the stronger indexes after hitting its 3 count. pic.twitter.com/Yc7yNHAcfd

The DJ Ind may have just finished their 3 count. We’ll see. pic.twitter.com/HNBOdZWkEw

The 3 count as I see it presently in the SP futures. These are 12 minute bars. pic.twitter.com/FASrwh9hAX

Market weakening and we may be sub stepping into 5 steps down instead of 3. Won’t know for sure until we make a lower low.

We don’t have an end to the recent decline until we break the trend line for this decline. This hasn’t taken place yet.

I count 3 steps down in the futures. If “true”, a rally should take place. If we are in a larger decline, this marks the end of step 1 down.

Lots of trend lines on pages 6 and 7 stockcharts.com/public/1169350

First 2.5 pages of my charts have the best indicators. Lesser indicators follow, not bad or unreliable, just lesser. stockcharts.com/public/1169350

Read about the Elder Impulse System, which is used on my index charts.stock-market-observations.com/2012/01/30/eld…

Page 6 of my charts are daily & 2 hour. Page 7 is monthly & weekly charts. All are displayed in Elder Impulse System stockcharts.com/public/1169350

My charts are shorter & if you’re only interested in indicators, see the first 5 pages. For charts, see pages 6 & 7. stockcharts.com/public/1169350

Gann said that markets tend to top on or around Sep 22nd more often than any other day. This is also the date of the Autumnal Equinox

SP 500 trend line since Mar 2009 bottom. This is not a log chart. pic.twitter.com/Z1z3FPUGvR

Jeff Saut says “I think Dow Theory “trumps” everything because it tells us the primary direction of the equity markets,”

@spirocks If you have a multiple personality disorder, you can lie to both of us

@Stock_Trend_Chg Decent record getting MAJOR inflection points correct

All of the charts displayed today can be seen at My Charts linkstockcharts.com/public/1169350 I have also reduced the number of charts

Trend lines and cycles for Value Line Index since 1980 pic.twitter.com/JX9BIlN4VO

SP 500 trend lines, cycles and wave counts since 1980. pic.twitter.com/7QTgJVMht2

Possible trend lines for Russell micro cap index pic.twitter.com/cARWjtqiT9

Short term Pitchfork for bank index pic.twitter.com/LYvbIxqvBB

Russell top 50 trend lines Index is the 50 largest cap stocks pic.twitter.com/dKPk7MpmKA

Russell 1000 trend lines Index is the largest 1000 stocks pic.twitter.com/VJrVySpcII

Russell mid cap trend lines pic.twitter.com/XXuUPtohNe

Russell micro cap Pitchfork trend lines to the downside pic.twitter.com/KRxCqO7ZIS

Semiconductor index Pitchfork trend lines pic.twitter.com/hSdHoNMJIp

The weekly unemployment claims continues to strengthen. The job claims is inverted from its normal downward trend. pic.twitter.com/WTtczpm7CH

Is GE leading the market lower??? pic.twitter.com/kK4FMiuct7

Smaller caps went from leaders in July to extreme laggards. Smaller caps are ready to go negative for last 4 months pic.twitter.com/2wdtWR7cc0

Russell index weakness is spreading from the micro caps to the larger caps pic.twitter.com/UGiKM2HfUe

Emerging market stocks are warning of impending weakness pic.twitter.com/GzjMsfOAOZ

Volatility warnings of an impending market decline. The most recent warning was last week. pic.twitter.com/Te1Td0yuV5

This chart says we are in 2nd step down. See this link for an explanation of my wave counts stock-market-observations.com/2011/07/02/odd…pic.twitter.com/nX5yNbZLjw

Percentage of today’s declining volume and declining stocks was about 85% each. 90% represents an extreme figure.

Longer term overbought oversold oscillators are nearing an oversold reading. pic.twitter.com/couNsIDF98

Lotsa weakness in the NYSE stocks above their 20 day MA. The decline just began, but this is closer to recent bottoms pic.twitter.com/AdROQipslE

Finally weakness is showing in the SP 500 average price relative to its 52 week high low pic.twitter.com/oZoRY0nWH9

Also weakness in the SP 500 for stocks above their 50 day MA. pic.twitter.com/EPev2bcFkI

On the recent peak, the SP 500 was showing signs of weakening for stocks above their 200 day MA pic.twitter.com/NXDkkG9G1G

Stocks above 200 day MA on NASDAQ are growing weaker. Ditto for ALL small cap indexes showing 200 day MA weakness pic.twitter.com/cHFl082AXm

The put call ratio isn’t in sell territory. Is it infallible, no, but it has a decent record of getting calls right. pic.twitter.com/zi4SxLXkv9

NASDAQ high low ratio has been in a correction mode for the last 2.5 weeks also. pic.twitter.com/TyUfL17awA

NYSE high low ratio has been in a correction mode for the last 2.5 weeks. pic.twitter.com/veJ5DHZaip

Cumulative advance decline is now leading the market lower. pic.twitter.com/Vom5uM9fTB

Was last week’s breakout a bull trap?? We’ll find out if we break significant lows. If not a trap, we’ll see more upside before a reversal.

Alibaba’s PE ratio is 60 (at $90). Google PE is 31, Amazon PE is 504, Netflix PE is 165. Is Alibaba in the same class as these stocks???

Alibaba IPO price was $68, reached $97 opening day & now trades at $90. Julian Robertson loves Alibaba. Remember when Google IPO was $85????

Breaking the trend since Oct 2011 is the big Kahuna, after that, a significant market correction can take place. When does that happen???

@taxfreelt Hard to tell, large caps are stubborn, small caps are already in decline. When we break trend since Oct 2011 the rout will be on

Not a good day today. The DJIA is down about half of the decline in the SPX. Smaller the cap, the bigger the decline pic.twitter.com/NkIGoZKABO

Do my charts mean the market is going to decline immediately? No, but . . . And markets usually go much higher than thought possible

Is Emerging Market Currency leading the stock market to the downside??? pic.twitter.com/oai0wmzQ3V

Is GE leading the market lower??? pic.twitter.com/V1u7fZgSI7

Weekly unemployment claims (inverse chart) are moving lower as economy strengthens. QE ends soon & what happens then? pic.twitter.com/YISi3hNYk3

Japanese Yen and the US bond market are almost in lock step. pic.twitter.com/C51vyqm1x5

McClellan Summation Index has been falling while large cap indexes are making new highs. pic.twitter.com/jDlNc9IsM9

New highs in the large cap indexes, but stocks above their 20 day MA were falling instead of confirming indexes pic.twitter.com/BfLvWTDzdb

Bearish divergent action between cumulative advance decline & large cap indexes, AD line failed to confirm new highs pic.twitter.com/EPMaMjqAFi

Breadth indicators very negative, seasonality for the next 2 weeks is negative. Conditions are in place for a cycle top. – From Mike Burke

Hindenburg Omen occurred on Thu & Fri. Signal not been valid in recent years, but conditions are similar to previous significant declines

The SKEW index has been in an uptrend since late 2013. As the index goes up, the odds of a correction go up too. pic.twitter.com/dy2gfS5UQc

Since Nov 2012 SP 500 has had corrections of -8%, -6%, -4% and -4.5%

My Charts can be seen at: stockcharts.com/public/1169350

My Charts are showing that small & midcap stocks are performing poorly Seasonality suggests that they may outperform in Nov & Dec???

Greed and Fear of Markets The excitement over the Alibaba IPO is in direct, opposite proportion to the fear after Lehman’s failure

Russell 1000 (top 1000 stocks) New intraday high with a loss and an outside day – both potential reversal formations pic.twitter.com/zYi0r4Lv92

Today I’m seeing an outside day on many stock market indexes. Some indexes had new intraday highs signifying – reversal day. Double Whammy!!

NO wins in Scotland and that’s carrying over to Wall Street tonight.

Patience is good in the stock market, but some never learn to wait for the right moment. pic.twitter.com/TIM0mlyqbe

In 2008 stocks were a good buy . . . Goodbye Mercedes, goodbye yacht, goodbye vacation home, goodbye . . . Ed Hart (modified for today)

Market Correction – The day after you buy stocks. – Anonymous

Money talks, but all mine ever says is “goodbye” – Anonymous

Those who can . . . do Those who can’t . . . teach Those who can’t teach . . . work for the government. – Anonymous

P/E ratio – The percentage of investors wetting their pants as the market keeps crashing. – Anonymous

Often times WHEN you take a position can be more important than WHAT you take a position in. – Anonymous

The public is right during the trends but wrong at both ends. – Humphrey Neill

Nobody is more bearish than a sold-out bull. – Anonymous

A buy and hold strategy is a short term trade that went wrong. – Anonymous

A bubble is a bull market in which you don’t have a position. – Anonymous

The hardest part of a bull market is staying on. – Anonymous

This is expiration week for Thursday & Friday. We don’t get the crazy volatility like in the old days, but some volatility is expected.

Market is oversold & should rally more, but SP500 is finding it difficult to rally at the moment. pic.twitter.com/en0doAFVWX

4 day Fibonacci fan is working very nicely showing resistance and support on the SP 500 futures pic.twitter.com/GXYfJDv09Z

Close up view of the John Murphy chart immediately below. pic.twitter.com/NL1siwkqtK

John Murphy Favorite for long term signal Above the zero line is a bull market, below the zero line is a bear market pic.twitter.com/GL3NN0PZWT

Stochastic buy/sell signals for the Russell 2000, ETF is IWM pic.twitter.com/TRYgep49pp

Total market cumulative advance minus declines versus the SP 500. Negative divergence taking place presently pic.twitter.com/44yxufeNMC

Putt / Call Ratio showing moving average extremes for a buy or sell point. pic.twitter.com/4BTnl5nzb8

All of the preceding charts seen here are available at the following link:stockcharts.com/public/1169350

Stocks making a 52 week high in S&P 1500 are in a bearish divergence with index prices, slow topping indication pic.twitter.com/cUife90OTT

Stocks making a 52 week high in S&P small cap index are in a bearish divergence with prices, slow topping indication pic.twitter.com/4jbaL1kcjC

Another chart showing loss of upward momentum in the number of stocks above their 200 day MA in the SP 600 index pic.twitter.com/vbGCVWOJB8

Showing loss of upward momentum in the number of stocks above their 200 day MA on the NASDAQ, slow topping indication pic.twitter.com/RSCXZpBtcJ

My Stock Charts stockcharts.com/public/1169350

Follow my blog – Find some different ideas, papers written by Edson Gould, Terry Laundry, unique wave count theory stock-market-observations.com

Paul Desmond wrote an article on market bottoms, which won the Market Technicians (MTA) Dow Award in 2001. mta.org/eweb/docs/2002…

Paul Desmond’s of Lowry Research lowryresearch.com wrote an article on market tops. stock-market-observations.com/2014/05/27/527…

If interested, you can read about the Elder Impulse System at the following link stock-market-observations.com/2012/01/30/eld…

Usually, the first warning sign that a Bull market is losing upward momentum occurs when the % of stocks rising to a 52-Week High contracts.

Tell your friends, neighbors, relatives, enemies, psychos and the homeless to become a FOLLOWER OF MY TWEETS.

Dow Theory Buy Signal – this is 2 days in a row for a buy signal. It’s not yet a significant new high for the industrials

Dow Theory Buy signal will occur today if the industrials & transports close somewhere near present price levels. It seems to be sure thing

The main purpose of the stock market is to make fools of as many people as possible. – Bernard Baruch

If all you have is a hammer, everything looks like a nail. – Bernard Baruch

I made money by selling too soon. – Bernard Baruch

Men, it has been said, think in herds; it will be seen that they go mad in herds, while they only recover their senses slowly, & one by one.

Emotions are your worst enemy in the stock market. – Don Hays

Stock are bought on expectations, not facts. – Gerald Loeb

If you have trouble imagining a 20% loss in the stock market, you shouldn’t be in stocks. – John (Jack) Bogle

The chart possibly shows 3 steps up. What appears to be 2 close steps is likely 1 step. Step 3 may still be ahead??? pic.twitter.com/JX7NHXEU9l

Yup, that’s me staying at the cardboard box suites behind the Four Seasons pic.twitter.com/gLbhKlDLos

“This time it’s different” was prevalent during the bubble of 2000. In 1929 it was called “New Economics”. – Bob

The four most dangerous words in investing are “This time it’s different”. – John Templeton

The rally today was due after completion of a 3 step decline. Rally may see new highs, but significant new highs??? pic.twitter.com/qm2mzhmapN

Today was unusual prior to a FED announcement. Normal is a flat market. If tomorrow morn. is STRONG to upside, expect more of same after FED

Today was a good bounce for large cap stocks. Smaller caps had half of the large cap gains. See – PAGE 5 CHART 7 stockcharts.com/public/1169350…

Dow Jones Industrials and a Fibonacci fan since the 2000 peak pic.twitter.com/tn7uDDEymG

Dow Jone Industrials since Oct 1928 and the overall wave count since 1929. pic.twitter.com/vdKcCzXTKf

Dow Jones Industrials since 1966 and the wave counts during that period. pic.twitter.com/OOlquAPSJ7

HIO junk bonds has been in a downtrend since Jan 2013 pic.twitter.com/8lzp5MmwcT

Junk bonds (JNK) since 2009 bottom, converging triangle since 2011. pic.twitter.com/pNHnUK9VYU

Trend lines, wave counts, Fibonacci lines for Russell 2000 since late 2009 pic.twitter.com/WEuB7zdiOb

Trend line channel since June 2012 in the SP 500 pic.twitter.com/LHxnfeunkt

Trend line channel since 2009 bottom pic.twitter.com/5uIyxzrpkb

Gold ETF & we’re looking for a “possible” break of the current trend channel, beware subdivisions extending the trend pic.twitter.com/kwk9iy5wkk

The count since Aug 8. FED announcements can make counts difficult to follow by wild swings in both directions. pic.twitter.com/9ap9f3rUQI

The Russell micro cap index has a downside trend line still intact. pic.twitter.com/KSeAqfTmlo

A “possible” new trend line? Will the top line hold over next few hours. FED announcement may shred this trend line pic.twitter.com/LslqjW0Lev

SHORT TERM CYCLE Recent cycle lows have occurred 1 day earlier than designated. Yesterday’s cycle low was 1 day early pic.twitter.com/byoQrssNcO

Same cycle as below in present. Cyclic lows have been shallow since 2009. Next cyclic low anticipated around May 2015 pic.twitter.com/tOFBx9gaCo

HISTORY: Crude intermediate term cycle of market action before 2007 peak & after the 2009 bottom. RELATIVELY accurate pic.twitter.com/vittPW3W0u

Rule#1: Never lose money. Rule #2: Never forget rule #1 – Warren Buffett

Buy on the cannons, sell on the trumpets. – Old French Proverb

The time of maximum pessimism is the best time to buy and the time of maximum optimism is the best time to sell. – John Templeton

The market prior to FED announcements consist of (1) FLAT TREND (2) Decisive & CONTINUING moves usually carry through after the announcement

The declining channel that existed since Sept 3rd has been broken on the upside. Fireworks begin for real at 2pm Wed. pic.twitter.com/cITxRHLsea

Cell phone only lanes in China Ever wonder if USA is falling behind technologically & isn’t innovative anymore?? LMAO pic.twitter.com/Mf0cOxbSPm

“The essence of investment management is the management of risks, not the management of returns.” – Benjamin Graham

Not good odds for this month. When the SP 500 was up more than 3% in August and at 12-month high, September was up only 8% of the time.

I know old traders, and I know bold traders, but I know no old and bold traders! – Anonymous as retold by Jeff Saut

Minor breakdown on these trend lines today pic.twitter.com/ReA76BcXTS

Very short term count for the SP 500 Several possible trend lines for the current decline (blue and green lines) pic.twitter.com/6WOV9Xn33N

Stocks fell as investors speculated FED may raise interest rates sooner than estimated cuz retail sales climbed at fastest pace in 4 months

The NASDAQ is not really in a down trend. This is a horizontal formation presently. pic.twitter.com/2fU4nUseNA

An early trend line possibility, we’ll see if it holds up for awhile. pic.twitter.com/FmE1pp5Nc5

Credit above tweet to John Murphy at StockCharts

Stocks favorable with strong $ $ – green area SPX / World Index – black line 1999 decline was from asian money crisis pic.twitter.com/BnFbZwkIei

Credit the above tweet to John Murphy

DOLLAR APPEARS TO BE FORMING MAJOR BOTTOM RISING DOLLAR IS BEARISH FOR COMMODITIES STRONGER DOLLAR FAVORS U.S. STOCKS pic.twitter.com/IQLaORwU1z

A long trend channel for the SP 500 pic.twitter.com/L8FpMXcIIT

Is gold extending down into a 5 count, or making a double bottom? 5 count reinforces deflationary scenario in Europe pic.twitter.com/GaaU1ttObb

Russell micro cap index stopping a decline at the lower pitchfork level pic.twitter.com/ASzWWmtagw

SP 500 over the last month with a 5 count and a correction pic.twitter.com/GcopgmQOI2

NYSE index over the last month But many other indexes have gone to new highs well above the prior high. pic.twitter.com/4YoScLQvcg

Junk bonds (JNK) over the last month pic.twitter.com/PuuowOTTFN

Banks over the last month pic.twitter.com/NVwW8hrKQj

DJ Industrials over the last month pic.twitter.com/ygElDF8xou

Jeff Saut remains cautious & we’re in a secular bull market. His “but” is we could have a correction. He mentions things that bother me too

Shallow trend line in the micro cap Russell index pic.twitter.com/ysVDTwAeNb

Worst case scenario is that the megaphone could be ending soon. No clue which long term scenario is in place.

OIL BREAKS TO NEW LOWS AND TAKES GASOLINE WITH IT. More higher dollar repercussions.

“75% of American Adults are concerned about inflation.” – Rasmussen, August 24

“Eight-Year Loans Fuel Car Sales as Debt Warnings Ignored” “On a 96-month loan it takes 80-plus months before you are back in the money.”

“New-home prices [in China] fell last month. In Wenzhoa, 56% of the homes were abandoned due to falling values.” from Bloomberg, August 20

“We have more leverage and more derivatives risk than we’ve ever had.” from the Financial Times, August 20

Historical steps since 1928. Today we are in a very large megaphone formation. This formation “may” take years to end pic.twitter.com/Xl3pCM9MsE

A significant decline within the bull market channel could label the bull market since 2009 as a large step 1. Followed by steps 2 & 3.

A couple of years ago I became aware of a possibility of a significant decline and still continue the prevailing bull market. (continued)

Recent step history. It would take a large decline to break the channel for the 2009 bull market. (continued) pic.twitter.com/fHIGn62hPc

This looks like a bad news is really a good news event. Bad news means FED might not end QE.???? The step up since Oct 2011 is geriatric.

The count up since 8/7/14 “could” be as pictured. Without a channel break there’s no trend break or reversal pic.twitter.com/ldbKgrk91M

Action by the ECB to weaken Euro to combat deflation would push the dollar higher. This would push commodity prices even lower – John Murphy

Look at the plunging Euro. Euro zone has lotsa problems, wondering how their problems will affect USA (trade) ??? pic.twitter.com/2wBbWTfjGf

John Murphy was showing today how the rising dollar is lowering the price of commodities (including oil) pic.twitter.com/BgGA3at17F

“My Charts” – Indicator Explanation – Page 1 has been posted to my blog, use the link below wp.me/p1DRwF-30N

(Putin’s) . . . reminder that Russia is a major nuclear power. To me, it is pretty eerie our markets can ignore such rants. Says Jeff Saut

“My Charts” – Indicator Explanation – Page 1 wp.me/p1DRwF-30N

—————————————————

- Please follow MY CHARTS so I’m not relegated to the dung heap of nobody is interested in this crap. You only have to follow once. Click the blue icon seen in the upper right of each page that says “Follow”. After you’ve clicked once, the blue icon should change to “Unfollow”. Leave it so it says “Unfollow”.

—————————————————

- Click on any chart to enlarge it

- All Rights Reserved © ™

- Leave me a comment just a few inches below, look for:

- If you only see the following:

- Click on “Be the first to comment” and you’ll see: