2015 Tweets by Bob

- My charts consist of all the items that Paul Desmond warned about in his paper, “The Warning Signs Of Major Market Tops”, which you can find at the following link

WAVE COUNTS

- If you aren’t familiar with my unorthodox wave counting method, there is a simple explanation at the beginning of the glossary. The glossary also contains lots of other details (explanations) that don’t appear in the blog.

TWEETS

- A lot of visitors to my blog are looking for information on T-Theory ®. The below link will take you to the index of all of Terry’s comments during the period Dec 2003 to June 2011. There are a considerable amount of charts and audio material from Terry Laundry in this section.

- If you are looking for the ability to make your own predictions using T-THEORY ®, I would highly recommend Terry’s Encyclopedia on T-THEORY ®

- Order the T Theory® Encyclopedia from Paula

EDSON GOULD

Dec 2015 – 107 TWEETS

Most of the world’s indexes are fractionally on the downside today pic.twitter.com/f9LEjJXsyj

Chart has 2 outcomes for 2nd step up: 3rd step up still to come Deeper correction ahead if 2nd step up is finished pic.twitter.com/0DEWNa7Waz

Worse than a double bottom could be heading our way too. pic.twitter.com/u6JU3Mm9lm

HAPPY NEW YEAR (in about 12.75 hours for me)

Transitional period appears to be taking place. This morning’s low could become a double bottom before rally begins pic.twitter.com/PJ0CHztQFK

The recent decline as seen in several indexes. I can count 5 steps down to this mornings low pic.twitter.com/sDTqSwVp4L

World markets stay on the downside moving into the US close pic.twitter.com/cs15tQWajz

Interesting lines, trade on color change or line penetration. I like line penetration as a signal generator pic.twipic.twitter.com/1BC8E4Y8RC

Market isn’t holding the support that it generated earlier today. Looks lower to me for a bit longer pic.twitter.com/Fx8pyAFpop

John Murphy CONSUMER STAPLES IS A DEC LEADER CYCLICALS AND INDUSTRIALS LAG BEHIND ROTATION FROM CYCLICALS TO STAPLES IS A SIGN OF CAUTION

One of the charts from my StockCharts public page, PAGE 2 CHART 1stockcharts.com/public/1169350… pic.twitter.com/pHP6nVWafk

Most of the world is on the downside today showing fractional declines except for the top 5 indexes pic.twitter.com/Oqjp87uxVJ

LONG TERM = BEAR Or short term with > loss tolerance SHORT TERM = HOLDING SHORT TERM BUY POSITION wp.me/p1DRwF-332

Minimal correction today. If tomorrow’s rally fails, I probably will leave the party. pic.twitter.com/tBXx3c0fT5

Looks like we may have completed 3 steps down. If so, the close should rally from here pic.twitter.com/Q1hb5lnJL1

Looks like most of the world is on the downside today. We’ll look at the close carefully. pic.twitter.com/57QFcobwdA

It makes me wonder why I’m still holding a short term buy position. As I said before, if Santa doesn’t show next week . . . I’m gone

Put Call ratio is on the edge of another sell signal pic.twitter.com/TcFvyDc8Aj

Half of another Dow Theory sell signal pic.twitter.com/Sr8zmjsLay

LONG TERM = BEAR Or short term with > loss tolerance SHORT TERM = HOLDING SHORT TERM BUY POSITION (WHY???) wp.me/p1DRwF-332

If Santa rally doesn’t appear next week, I will sell my short term buy position

This doesn’t look encouraging pic.twitter.com/PSKL7jxAMM

Strong forces are at work if stocks go against the decade seasonality . . . or any seasonality tradition pic.twitter.com/MUSJxJ7jgx

Performance of years ending in a “5” are the strongest year of the decade. pic.twitter.com/0lQJYjtsrF

Bankruptcies among oil & gas companies have reached quarterly levels last seen in the Great Recession – Federal Reserve Bank of Dallas.

Bloomberg At least 9 U.S. oil company bankruptcies in 4th quarter More U.S. oil company bankruptcies may follow next year

Dana Lyons The U.S. stock market has not been lower for any year ending in a “5″ since 1875…that streak is in jeopardy.

Shorter term oscillators have just reached an overbought level, longer term oscillators are shy of overbought pic.twitter.com/Lm3fTs4Iti

McClellan oscillator has just reached the first overbought level. pic.twitter.com/YnuWG5pkBX

Has anyone Googled my birthdate in the bio section of my page (it ain’t my real birthday)? It’s a very famous pivotal date in WWII history

HAPPY HOLIDAYS TO ALL Isn’t that PC of me? When I was younger, we said Merry Christmas & my Jewish friends echoed back Happy Hanukah Bob

LONG TERM = BEAR Or short term with > loss tolerance SHORT TERM = HOLDING SHORT TERM BUY POSITION wp.me/p1DRwF-332

Possible we finished 3 steps up, but there may be subdivisions in steps. Tomorrow could give a clue to subdivisions pic.twitter.com/I85W25PUt1

1 small step up should complete 3 steps. Do we get 5 steps into the end of year, or a lump of coal for Christmas?? pic.twitter.com/SfINBw0247

Value Line Arithmetic & Geometric Indexes with trend channel lines (not on a log scale) pic.twitter.com/0gGpclQU1I

Warning: Star Wars Spoiler ! imgur.com/gallery/7xc3hatpic.twitter.com/qgKx0Mr3BN

The Fibonacci golden spiral signifying the end or the beginning??? Crazy times, that’s for sure. pic.twitter.com/oFsSx4qviV

End of Mike Burk comments

Conclusion The market is oversold giving us a perfect setup for the seasonally strong period that runs to the end of the year.

Typically I would be cautious as the improvement might be called going from worse to bad, but this is happening at a seasonal shift point.

The positives The overriding positive is Seasonality, but, for the past week there have been breadth non confirmations.

Huge Fri volume, positions were cleared prior to a vacation. This suggests extremely negative breadth of recent past was seasonal pattern

The sell off has lasted 1 day longer than average, but that coincided with the end of the week before Christmas. Nothing surprising.

The negatives On average the market sells off into middle-late Dec then rallies for rest of month on low volume.

4 trading days before Xmas, 3rd year Presidential Cycle, NASDAQ composite has not been down since 1967 & S&P500 has not been down since 1979

The good news: It looks like traders closed out positions Friday ahead of a 2 week vacation. Nearly 10 billion shares were traded on Friday

Hmmmm, no bounce at close. That ain’t good. Normally I see a bounce at the close on Friday declines (multi-day down) pic.twitter.com/TmDeULW9Aw

Jeff Saut quote from Lucien Hooper pic.twitter.com/b2c5RNDtIc

“If Santa fails to call the bears will roam on Broad and Wall” – Lucien Hooper

Look at the percentage decline seen in this order: large, mid, small & micro cap pic.twitter.com/HwJyiEOM85

This chart says the FED should be worried about inflation???? Ridiculous!!!! FED should be worried about deflation pic.twitter.com/EVPDlC2tb1

LONG TERM = BEAR Or short term with > loss tolerance SHORT TERM = BUYING @ END OF CURRENT CORRECTION wp.me/p1DRwF-332

Oil drilling defaults on junk bonds??? This article seems counter intuitive, but that’s just my gut feeling bloomberg.com/news/articles/…

Half of renewed Dow Theory sell signal today (Transports). Industrials have a long ways to go before new sell signal pic.twitter.com/PpmFFc51C7

Seasonality says decline should be finished soon. IF NOT & market continues against strong upward seasonality, THAT IS A VERY BAD INDICATION

LONG TERM = A SELLING BEAR Or short term with > loss tolerance SHORT TERM = BUYING @ END OF CURRENT CORRECTIONwp.me/p1DRwF-332

3rd step down correction is possibly underway. A new low is below Dec 13, Fibonacci lines are resistance guide pic.twipic.twitter.com/rI9NRma7Sy

There are 2 steps down since Nov peak, buying here is a short term whirl. Gotta be careful, watch for higher highs!! pic.twitter.com/phGacWl1mL

Pick your buy points carefully like during a correction that has seen at least 2 steps down.

This rally can be bought for a few days (???) Something different is possibly taking place on this rally. We’ll see???

LONG TERM = A SELLING BEAR Or short term & > loss tolerance SHORT TERM = SHORT TERM BUYING BULL wp.me/p1DRwF-332

ADX daily gave a buy signal on the recent bottom pic.twitter.com/GIomaHAbyw

@wekim77 Obviously looks like 2 steps down, but looking at the RUT, it looks like 1 step down & is complete, so ???? pic.twitter.com/JlVeY0P2BM

How Investors Ignored Risk of Junk-Bond Rout? They must have been living in outer space.

Barron’s published 2016 Outlook issue this weekend, & not one of top strategists it surveyed forecast that the S&P 500 would fall next year

Mike Burk Conclusion Upcoming seasonal strength is about the only visible positive.

Mike Burk The positives Market is oversold & due for bounce & late next week enter a seasonally strong period that lasts until end of year.

Mike Burk The negatives New lows finished the week at their highest levels in several months.

Mike Burk The good news is: Last 9 trading days of the year, which begin next Friday have been, on average, the strongest period of the year

Junk bond sentiment over the last year pic.twitter.com/VGQpegxMHx

Junk bond sentiment over the longer term pic.twitter.com/udyOQgEAD7

Shorter term oscillator is oversold pic.twitter.com/sowjg4Ma4o

Longer term oscillator is oversold, only during Aug was this oscillator lower pic.twitter.com/Iblb6faqAi

LONG TERM = A SELLING BEAR Or short term & > loss tolerance SHORT TERM = @ NEW DOW THEORY SIGNAL, A SELLING BEARwp.me/p1DRwF-332

SMALL BUSINESS LENDING INDEX pic.twitter.com/1M2ezqBmqB

From Ned Davis Research Ignore Ned Davis Research at your own peril pic.twitter.com/8820YXg82D

WHAT???? It could happen again? Nobody told me that!!! History always repeats, only the details change. pic.twitter.com/3vhkyDhRvg

CARL ICAHN WARNS: I think the meltdown is only just beginning

Small & micro cap are near the limit of their envelopes, while SP500 has some wiggle room from its envelope limit pic.twipic.twipic.twitter.com/DeRU7FcRbj

Inflation, deflation chart pic.twitter.com/vwzBNiquGD

What was the big mover in the stock market today??? One important word . . . deflation Commodity deflation has been underway since 2011

It was a 90% down day today. If so, we could rally for a few days next week. (StockCharts error on prior chart) pic.twitter.com/FZER3u5V67

Both 60 min and daily ADX are at or near oversold readings, which “should” generate a temporary buy signal. pic.twipic.twitter.com/CrN65JfwEL

We have lower lows. SP500 broke the low of Nov 16 today. Next we watch the late Sep and Aug lows for penetration. pic.twitter.com/1Rb3I50kk4

Dana Lyons with so many stocks already having broken down, it’s only a matter of time before leaders fail to support weight of the market

Fibonacci radial from May peak showing an upper limit rally line. We’ll see if it continues to hold back the rallies pic.twitter.com/mZKz3BFgw1

ES futures threatening to take out the Dec 3rd low pic.twitter.com/cE8auCF5DP

2009 – present wave count using an indicator for count instead of only price, indicates 1 more upside move possible pic.twitter.com/gVlNZMqWPT

The governor of the Bank of Canada just said the three most controversial words in central banking: “negative interest rates.”

High flyers haven’t broken down yet. I would “expect” them to show weakness before the final stage is over, but ??? pic.twitter.com/DFFmapneZe

High beta stocks are out performing the SPX on the downside. SPX will play catchup later pic.twitter.com/4JVaVNIw8U

Watching DJ Transports to possibly break prior low that yielded a Dow Theory sell signal. pic.twitter.com/h0f0Xdl5XN

Ditto oversold on the longer term oscillators pic.twitter.com/CXsz0EMuIE

Getting kinda oversold on short term oscillators pic.twitter.com/rhl0p7yR5P

2003 to 2007 wave count using an indicator for the count pic.twitter.com/FawmWxp9uu

Downtrend count since 5/15. Waiting to see break of 12/3 low & then 11/13 low, OR whether we break 11/3 high – ???? pic.twitter.com/vKgRhGTCFY

Gun stocks rally after Obama’s prime-time address Yippee ki-yay

Rare streak may point path to ‘severe bear market Hmmm, seeing lotsa comments that look like this. No one rings a bell at the top or bottom

The anti-euro, anti-immigrant party of Marine Le Pen led in 6 of 12 regions in mainland France Sunday, increasing its share to 28% from 11%

If we Significantly exceed Wed highs (???) count could have 2 more larger steps up with likely new highs in SP500 pic.twitter.com/Y1dOB9YqKx

Big rally Friday but the new highs had little power. pic.twitter.com/Rlvu0D5Q6N

Mike Burk Conclusion We have a combination of Seasonal strength with weak breadth.

Mike Burk The positives The breadth indicators are mostly weak, but, in about a week, Seasonality becomes very positive.

Mike Burk The negatives New lows finished the week at their highest levels in nearly a month.

Mike Burk The good news is: At the end of a very volatile week most of the major indices were up.

Nov 2015 – 200 TWEETS

Tweet #2 When the flow of money slows, the appetite for risk tends to decrease as well.

Tweet #1 When markets are flooded with liquidity, investors feel safer about investing in high-yielding assets, like “junk,” bonds, & stocks

See how wimpy the new highs are in comparison with earlier in the year. pic.twitter.com/Py0kNFgyQi

Value Line median stock price (geometric) compared to the average stock price (arithmetic) pic.twitter.com/TzWiiOtxhs

Long term wave count since 1974 to present pic.twitter.com/dpZZ0khhGE

Mike Burk The best December for the OTC was 1999 (+22.0%), the worst, 2002 (-9.7%).

Mike Burk During the 3rd year of the Presidential Cycle December has been up 62% time with an average gain of 4.6%.

Mike Burk Since 1963, over all years, the NASDAQ in December has been up 62% of the time with an average gain of 1.9%

Mike Burk The positives Because of the holiday, last week does not count for much, but, what did happen was good.

Mike Burk The negatives New lows decreased, new highs increased, a positive. SP500 & NASDAQ are 1.8% off their highs & new highs are lagging

Mike Burk The good news is: Last week the secondaries outperformed the blue chips

Advance decline line shows small & mid cap stocks have come alive recently, which is normal for this time of year pic.twipic.twitter.com/57rruxO2cp

RIP Richard Russell A great Dow Theory specialist who always got major trends correct I didn’t know that he had moved to N.C from La Jolla

LONG TERM = A SELLING BEAR Follow short term with greater loss tolerance SHORT TERM = A NEUTRAL BEAR wp.me/p1DRwF-332

John Murphy: THANKSIVING WEEK IS USUALLY GOOD FOR MARKET SO IS THE MONTH OF DECEMBER ESPECIALLY TRUE OF SMALLER STOCKS WHICH ARE TURNING UP

Forgot to mention the other day that junk bond sentiment can be the canary in the coal mine. With a peak in 2014, that’s a LONG lead time.

. . . Yawn

Junk bond sentiment has been poor for some time, meaning that investors aren’t buying junk bonds pic.twitter.com/WoiqypXuFl

Mike Burk Conclusion I think Weakness in breadth indicators means September low was not beginning of a new up leg, but a countertrend rally

Mike Burk The positives The breadth indicators have been weak, but Seasonality the remainder of the year is pretty strong.

Mike Burk OTC ADL was never strong as NYSE ADL, patterns are similar. OTC ADL peaked April & was weak in Sept rally pic.twitter.com/pyrapKAgte

Mike Burk Prices held up for months B4 catching up with downside ADL. NYSE ADL has also been failing with prices pic.twitter.com/7IuwpimFz6

Mike Burk OTC HL Ratio has been slightly stronger than NY HL Ratio, but also remained well into negative territory.

Mike Burk Secondaries underperformed blue chips & AD lines were flat. Strong rally in prices, NY HL Ratio is in deeply negative territory

Mike Burk The negatives Sensationally strong week for the major indices, NEW LOWS EXCEEDED NEW HIGHS EVERY DAY LAST WEEK on NYSE & NASDAQ.

Mike Burk The good news is: Last week the market had its best week in a while.

3 step decline underway, so far it is a minor move, waiting for end of down step to see quality of rally following pic.twitter.com/JghKoMesk8

Junk bonds (JNK) weekly chart showing wave count pic.twitter.com/axkPuoJR92

Valeant (VRX) could have made a successful bottom. Downtrend radial breaks should confirm the bottom. pic.twitter.com/z0BoKZUq8u

Alternative wave count #2 since 2009. This calls for another step up Trend channel breaks are the determining factor pic.twitter.com/pSYeQzt3ak

Alternative wave count #1 since 2009. This calls for another step up pic.twitter.com/Qvx2kGu8bO

This is the wave count since 2009 that makes me nervous. There are alternative step counts, next few tweets pic.twitter.com/2UbaBfCSQO

Clearly showing 2 steps up since the bottom on 11/13. One more to go. pic.twitter.com/8VR8S5HwZD

Stil in a small 3rd step up, waiting for conclusion to see what happens on decline pic.twitter.com/hiD9tUG3de

Still just plugging along pic.twitter.com/ifR9YQPthK

New highs are tepid for small, medium & large caps pic.twitter.com/Zxjy51Qkka

Equal weight SP500 ratio to normal SP500 is falling again pic.twitter.com/RwExrfVSlj

This is more like a normal step 2, spending time correcting advance. “Could” work off the oversold by going nowhere? pic.twitter.com/YhNbar1Nyz

Still oversold pic.twitter.com/pUphcyybrG

If rally should quickly exceed prior rally peak, might indicate that market is in a 5 step rally?? completing 2 of 5 pic.twitter.com/l8HowSRMPz

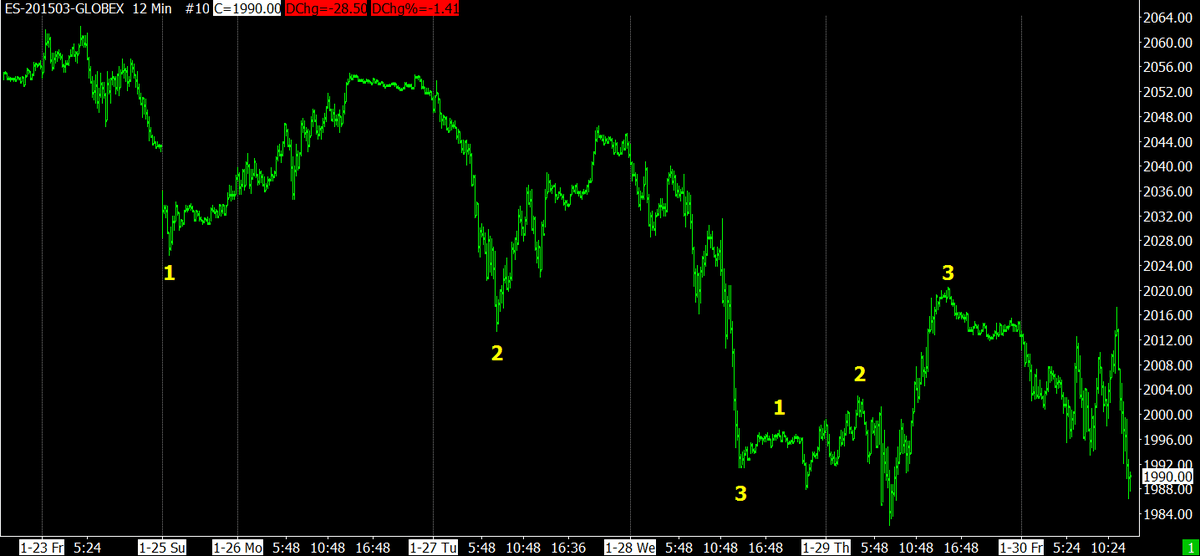

A well organized 3 step down occurred during the night & completed a short time ago. Rally is underway from decline pic.twitter.com/xAFYgBzKcj

How the day went using my moving average lines, 15 min charts 13 time unit 21 time unit 34 time unit 55 time unit pic.twipic.twipic.twipic.twitter.com/rzaZLX4l6b

Another strong burst upward tomorrow would be a horse of different color. I would likely scratch my head vigorously pic.twitter.com/1neaZIVUrW

Market will close near its daily high Dow Ind near Fibonacci radial. Likely to consolidate tomorrow after line touch pic.twitter.com/5y8QO7ZP8b

When bad news turns out to be good news. Important how market reacts to bad news Fed Minutes: December Could Well Be Time for Rate Increase

John Murphy % OF NYSE STOCK OVER 200-DAY AVERAGE IS SAME AS IN NOVEMBER 2011 & THINGS TURNED OUT OK S&P 500 EQUAL WEIGHTED ETF LAGS BEHIND

John Murphy STOCK INDEXES TRY TO RECLAIM 200-DAY AVERAGES SMALL CAPS NEED TO SHOW MORE BOUNCE

About 50 more Dow points upward and price will be against a declining Fibonacci radial pic.twitter.com/zABokGl8Cq

Small cap (chart 1) and micro cap (chart 2) are still lagging behind the larger caps pic.twipic.twitter.com/i3QzyEios5

Without a correction, the 60 min ADX is heading towards a sell signal in not many days. We’ll see how that goes. pic.twitter.com/WYWoeIapdq

I missed an ADX buy signal that was given on Nov 13 pic.twitter.com/F9mNvq0dIK

FED minutes today at 11 AM PST or 2 PM EST. The minutes may have something about raising rates and could whip the market around for awhile

Following yellow Fibonacci radial upward, but gray radial is making ES futures hang around area of declining line pic.twitter.com/zNFKJXgxuw

We started up in step 2 after a minor decline pic.twitter.com/n1PM9QlzB9

FED minutes are released on Wed at 2 PM Watch what market does leading up to release Watch what happens 30 minutes after release

Cheap Saudi oil is hitting domestic fracking oil production hard. pic.twitter.com/4Nzd9dNkYi

OK with more rally, larger rally may mean number relabel Step 3 can be the entire decline, as if 1 & 2 didn’t exist pic.twitter.com/O3zEUR2ZJO

We certainly have broken cyan step 2 down, but that doesn’t preclude more rally. More rally could be topping steps pic.twitter.com/ojlKJPECQi

That could be a 4 & 5 step down. If not, then expect a larger decline than a minor blip. pic.twitter.com/tji1pbbKVW

Patience is usually learned thru mistakes. That was how I learned patience. pic.twitter.com/VfX5Zg5dE8

Small 3 step down, we’ll see if its going to be a larger step up?? pic.twitter.com/VfzO4zLOYN

LONG TERM = SELL OR follow short term with greater loss tolerance Short Term = NEUTRAL (conservative) wp.me/p1DRwF-332

We’ll see how big retracement is “if” it has begun. 38% or 50% would be reasonable if trend is up for longer period pic.twitter.com/hRhZSHw8rn

I know this was a tradable rally & sorry I missed it, but I am a bit conservative until major direction is resolved pic.twitter.com/wAuNQFTkML

Market was oversold & due for rally, but I still wonder if this rally will poop out & decline back to area of cyan 2 pic.twitter.com/osZmOBLeXA

Fibonacci radial from May peak & radial from recent bottom. Resistance radial at current high today & 200 day avg pic.twitter.com/yM2wTJpS6M

@wekim77 Sometimes can have strong step 2 up move, strong enough to go all the way back to old highs before back down, we’ll see???

Sunday’s reversal came at projection level (purple) and a Fibonacci retracement level of 38% pic.twitter.com/TtjxK0Jn8Z

LONG TERM = SELL OR follow short term with greater loss tolerance Short Term = NEUTRAL wp.me/p1DRwF-332

Is that it, do we have a good bottom? Not by my count. Should have 1 more step. But I could be missing something???? pic.twitter.com/mcfbtw309s

ES futures bottomed on the Sunday open & rallied. We’re in step 3 up & it has become more vertical, more to go pic.twitter.com/chfJ0jEtcC

Je suis Française #ParisAttacks

Ce soir je suis Française

The S&P 500 lost 1.1%, widening this week’s decline to 3.6% while the Nasdaq Composite (-1.5%) underperformed to end the week lower by 4.3%

Looking at Fibonacci retracement levels shows this is not an unusual decline, but it is probably spawning fear pic.twitter.com/L5zXV7DnRc

Step 2 down is obviously a waterfall event, which is usually reserved for a step 3 pic.twitter.com/NbHeEet6xD

ES futures (SP500) showing a probable step 2 down in progress. Fibonacci radial shows support at current levels. pic.twitter.com/fMQzFV4e5P

John Murphy Today CYCLICALS LOSE LEADERSHIP PLUNGING RETAILERS CAUTION SIGN FOR MARKET SMALL CAPS LOSE MORE GROUND VIX CLIMBS BACK OVER 20

Is there a relationship with Sotheby’s peaking before the market?? It was a coincident peak in 2007. pic.twitter.com/yrg1WcShBM

Today DecisionPoint Scoreboards from DecisionPoint Chart Gallery lit up with 4 new Short-Term Price Momentum Oscillator (PMO) SELL signals

This still remain an interesting chart, spacing is equidistant pic.twitter.com/FyK50axx4O

It looks like gold began its 3rd step down since peak in Jan 2015 Inflation/Deflation looks stabilized for awhile pic.twitter.com/g74cF4tBy2

Lower part of chart is a John Murphy favorite, but I haven’t heard him comment on this indicator in a long time pic.twitter.com/rcKgDVFqLi

5 day Trin is oversold too pic.twitter.com/AAiRpdY6QV

All of the white background charts that I post are from my public StockCharts. stockcharts.com/public/1169350 Black backgrounds are Sierra Charts

New lows are rising significantly & new highs decline This is a problem Mike Burk has complained about for weeks pic.twitter.com/wmGkFNxps4

SPX new highs pooped out before small & mid caps did. see big divergence in last week of October for SPX new highs pic.twitter.com/LLMAVFb8tc

Equal weight SPX / Regular SPX ratio has been declining since late August. Only a few in SP500 are pulling the load pic.twitter.com/WrDUngZaRX

Put Call ratio gave a sell signal on Nov 1 pic.twitter.com/r8EJuYqlci

Dow Theory – major sell signal in Aug Minor divergence in Tran in early Nov Today Tran broke short term support pic.twitter.com/Fayn8SBct2

1st chart – small caps 2nd chart – mid caps Small & mid caps are falling hard including their advance decline lines pic.twipic.twitter.com/d4BVJ61vmC

1st chart – longer oscillators oversold 2nd chart – shorter oscillators oversold Summation index turned down @ +500 pic.twipic.twitter.com/UKqdfhgRZe

LONG TERM = SELL OR follow short term with greater loss tolerance Short Term = NEUTRAL/SELL wp.me/p1DRwF-332

No other index followed is very close to its limit envelope Possible count says finish current step down plus 1 more decline b4 bigger rally

NYA index is also close to its 60 minute limit envelope. Last time it was this close was on the late Sep bottom pic.twitter.com/JdzKxA3eUd

ES futures (SP500) is close to its 60 minute limit envelope. Last time it was this close was on the late Sep bottom pic.twipic.twipic.twitter.com/iRJ2sQTKwe

Upon that bright ray of sunshine, I’m going to lunch with friends “May the Force be with you”

Best Worst Case – Red III could bottom 25-30% below May peak Worst Case – We are in bear market aiming 3/2009 lows pic.twitter.com/bkkYgO7Hf8

If we are in red II down, we made important peak in May 2015. Red II & III could stop at substantially lower levels pic.twitter.com/1vpCECxJBW

Have to be alert is a possible red II down, below Aug Sept lows Otherwise We stop and rally into steps 4, 5 up pic.twitter.com/t4eqoC1REB

Only in step 2 down (cyan 2)? Purple line projections from early peak Grey lines are Fibonacci retracement lines pic.twitter.com/KzIxZV8U7Z

Status tweet is pinned to my profile page, you should keep track of my long term status tweet for any change. Short term is not a good gauge

“I haven’t spent enough time analyzing market” Shame On Me!!!! It took a reader (Michael) to poke me & wake me up to reality Thanks Michael

Make money while you sleep is the desired end result – I know it’s not possible, but I always try occasionally pic.twitter.com/uYCt05J5mR

I haven’t spent enough time analyzing market, because I’m working on automated buy/sell signal project – see chart pic.twitter.com/Mkwp2n08UB

Worst Case – RED step 2 is underway Best Case – YELLOW step 4 & 5 are still ahead pic.twitter.com/UMeSDnGDoZ

I’ve wandered off message & that is we MAY have made MAJOR peak in middle of May & decline is likely from that peak pic.twitter.com/3CIUE4rUNt

CLEARLY the correction following the recent peak has not finished, needs more time to digest rally since late Sept pic.twipic.twitter.com/q3WowsJoSq

Can’t see the forest for the trees My Bad Mistake – Short term & ignoring intermediate pic, should have called quick exit on QUICK flip buy

LONG TERM = SELL Follow short term with a greater loss tolerance Short Term = NEUTRAL/SELL wp.me/p1DRwF-332

This “could” be what’s happening short term, a lower 3 is about to occur pic.twitter.com/bYDkOLF8Uw

I don’t see the wave count differently here for ES or NASDAQ futures BUT DJ Ind do look different – next tweet pic.twipic.twitter.com/8pDpE3KPpd

I assume that every tweet reader has access to a live chart to keep current, but if not ES futures (free) investing.com/indices/us-spx…

Or the count could be going like this, if 3 step up & then goes below yellow 1 down, abandon long positions pic.twitter.com/KaEwaloJqW

Probably what’s happening, a small 3 step correction, if it breaks through the 7:50 am bottom, it’s more than small pic.twitter.com/4TFVXKCPFN

1st chart, NASDAQ futures show the steps, 2nd chart, ES futures is not as well defined, Follow the NASDAQ steps pic.twipic.twitter.com/UrqA1Y8b1l

Rally is underway with nice profits for those who anticipated early. pic.twitter.com/5wT9SBrM2T

DJ Ind futures & NASDAQ futures in step 5 down, a rally “should” come after this small 5th step down is finished pic.twipic.twitter.com/Ay3lfCGhi1

LONG TERM = SELL Follow short term with a greater loss tolerance Short Term = Buy quick flip Short decline fini? wp.me/p1DRwF-332

Rally coming, in step 5 down, but it doesn’t look finished. Need to see a rally above high that followed step 4. pic.twitter.com/i3cYMD3fRt

SPX Fibonacci radial showing resistance presently pic.twitter.com/p9SNFrnD8G

Short Term = Sell if comfortable No one is comfortable if you have loss, but mark yourself to the market EVERY DAY to keep reality in sight

3 step rally late today in ES futures, can’t tell if step 3 is finished (needs further decline), or if a 4, 5 needed pic.twitter.com/NPfLbRETw4

Next Fibonacci radial on each chart is approximately at the same price level. Could be a rally point? We’ll see? pic.twipic.twitter.com/eKPpdaxqsg

1st chart, Fibonacci radials from Aug bottom & Sep peak 2nd chart, Fibonacci radials from Aug bottom & Oct peak pic.twipic.twitter.com/KGWf61I2ML

LONG TERM = SELL Follow short term with a greater loss tolerance Short Term = Sell if comfortable Rally finished wp.me/p1DRwF-332

Should have decent decline if step 3 is finished, but sub-stepping could interfere with this count. Gotta wait & see pic.twitter.com/pZHbArSERn

NYA count leaves open possibility of step 2 & 3, which would be steps 4 & 5 in the SPX pic.twipic.twitter.com/xiS4B4zGlY

Different wave counts between SPX and NYA. This happens frequently and you have to judge how it plays longer term pic.twipic.twitter.com/D4gIDpF8S8

Chart labeled as yellow 4 down, but is it yellow 5 down? Cyan 3 isn’t yellow 1 down cuz needed cyan 3 up completed pic.twitter.com/8IYwa08EN8

Good projection that hit the target precisely, based on closing figures & then showing intraday figures hitting peak pic.twitter.com/rMJk9tcXbs

Not too much doubt that we broke the prior channel. Gotta take the ? marks from steps 4 and 5. Now what happens?? pic.twitter.com/Y5xKf16YC5

Mike Burk Conclusion New lows have been increasing, the AD lines have been weak and Seasonality is weak for the next 2 weeks.

Mike Burk The positives You have to go back to mid July to find more NASDAQ new highs than we had on Friday.

Mike Burk The NYSE ADL has been stronger than the OTC ADL, but it has also come up short for the past 2 weeks.

Mike Burk Ideally the Advance Decline Line should be running parallel to the SP 500 Index & DJ Industrials, instead the ADL lags far behind

Mike Burk The negatives: The advance – decline lines (ADL) have been persistently weak and new lows have remained high.

Mike Burk The good news is: Last week the secondaries outperformed the blue chips for the first time in quite a while.

Sunday evening trading in ES futures begins a new day. We’ll see what happens then. I’m going to work on the chores I’ve put off for so long

SPX (ES futures) didn’t do anything today to break the decline channel pic.twitter.com/D3DlAIfZFg

Valeant (VRX) pic.twitter.com/fYN6L5bBBZ

Valeant (VRX) Price Target Cut to $195 at Guggenheim after prior target of $300; Thesis Intact says Guggenheim

Valeant Pharma (VRX) May Be Seeing Real Institutional Buying

Valeant CEO Mike Pearson had pledged 1.3 million shares as collateral were sold 10/5 due to margins calls.

Reuters Bets on Valeant Pharmaceuticals left some hedge funds nursing heavy losses last month when the stock price tumbled nearly 50%

Russell top 1000 and Russell mid caps, both have looked a little sick recently pic.twipic.twitter.com/PfQWkOPRyw

Today the micro-caps did make a new recovery high, catch-up or late finish???? I’ll go with a late finish pic.twitter.com/kOdkYMKVpf

Putting the small caps in perspective since their bottom pic.twitter.com/mPdWlDAEPZ

Today the small caps want to challenge their recent high pic.twitter.com/vV2wA4XoNw

5 steps up since late Sept bottom in NYA, this chart indicates it’s very likely the decline has further to go pic.twitter.com/DCP4hi5M0g

ADX lines moving away from the extreme levels noted recently pic.twitter.com/6xe4nJv7zV

3 different price projections that have been fairly accurate, each has higher projection waiting for steps 4 & 5 up pic.twipic.twipic.twitter.com/IqQS8cQrhE

Ditto on this one pic.twitter.com/qAvU3KHUOy

Waiting for confirmation on this wave count pic.twitter.com/QWHOFjGpML

No confirmation that the white 3 was the end of this step up pic.twitter.com/HrfFK918UK

Waiting for confirmation of the 4 & 5 in this wave count, needs lower lows to confirm pic.twitter.com/zOAhliqRXk

Two possible wave counts on VRX, either may be correct, but for now I am going with step 5 happening now pic.twipic.twitter.com/8Er4AB7EJl

1 more step down and it might be all finished on its waterfall decline, but that ain’t engraved in stone. pic.twitter.com/Ejvi1wHhhz

Short term wave count, rally now, but how high? Possibly no new high on this rally, but if we do, then steps 4, 5 up pic.twitter.com/r7NewYKJDq

Catch a falling knife anyone??? Not me, not yet. pic.twitter.com/ynGB1UbQT7

Long term daily chart for Valeant, parabolic??? pic.twitter.com/CTfLj707qL

Doesn’t this remind you of Lehman? If Valeant went bust it could mess up a lot of funds, maybe a crippling blow? pic.twitter.com/lIXsb2XNVi

Close up of Valeant Fibonacci radial & step count. Last step down doesn’t count as complete, one more step needed pic.twitter.com/KPgOSqvNy9

I own this stock by way of Sequoia Fund pic.twitter.com/WWaOle72UI

Need to see significant reversal for last step to be completed, higher high would be important for reversal pic.twitter.com/iVrRVLnxx0

Biggest volume spike earlier today. Institution bailed out, WHO? Remember, another institution was there to buy it pic.twitter.com/z3l7k8R3hO

Of course if Valeant did miss a royalty payment, then things may really be wrong. LOTSA institutions hold this baby pic.twitter.com/bouQutKD9W

Valeant Pharmaceuticals keeps going down, but the decline may be close to finished, Fibonacci radial and wave count pic.twitter.com/xGQVm2q5vA

LONG TERM = SELL Follow short term with a greater loss tolerance Short Term = Sell when comfortable Rally peaking wp.me/p1DRwF-332

Will the market rally after hitting the cyan trend line? If rallies back to new high, then step 4 & 5 labeled wrong pic.twitter.com/R1540cgTCx

@wekim77 Don’t know, but it means money is leaving the stock market and trying to find a safer haven

Another look at the wave count in the ES futures pic.twitter.com/ASNBEHz7lb

I’ve redrawn the trend line (red) for ES since the Sept bottom. I like red trend lines better than the older cyan pic.twitter.com/CQezzw7zpQ

ES futures since late Sept low with channel trend lines still in force. pic.twitter.com/FzhbsI8P52

Short term wave count as it stands today. Is 3 finished, or will there be a 4 and 5? pic.twitter.com/16KIGK38QA

ADX from my StockCharts pic.twitter.com/fq2U5cTtoC

Small business lending index through Sept pic.twitter.com/wocf6VhizA

Jason Goepfert Mutual fund investors giving up. Over past 6 months, sold $100 billion of domestic mutual funds, largest outflows in 30 years

Indicating narrow leadership, Russell Top 50 & NASDAQ 100 have made new highs. Only a few stocks are leading rally pic.twitter.com/huC6MQZaXa

New highs are not keeping pace with this advance. Even SPX new highs are lagging. pic.twitter.com/zfLAO7YUc6

Slow Stochastic is above red line pic.twitter.com/Jbgt4Q831N

Put Call ratio slowly degrades towards the sell line of the envelope pic.twitter.com/m20Xx9m68p

Shorter term oscillators in this chart. pic.twitter.com/XgtNQCEvnm

Good sign when market remains overbought for longer period of time. pic.twitter.com/l5URxXk6X3

Small caps are putting on their best show since beginning of the rally in early Oct. Catchup? Or closing blowoff? pic.twitter.com/cONdYjK0Cl

The NASDAQ Composite is on the top of its envelope. Past reversal have come from the peak envelope point. pic.twitter.com/nX9BVbeMyM

DJ Industrials are near the top of their envelope, limiting future gains pic.twitter.com/BRhQD0VOjx

ADX is close to a daily reversal point, but isn’t quite to an EXTREME level yet. pic.twitter.com/Qsu5CNQPtE

ES futures (SP500) remains within its long trend line from 9/29. ES has a subdivided wave count also pic.twitter.com/7K7XcKA0Gn

Stock market has accelerated to the upside in subdivided 3rd step. Purple trend lines are steeper than steps 1 & 2 pic.twitter.com/VdQNyleO4q

Next projected Fibonacci resistance level is SPX 2139 (new high) pic.twitter.com/6NECLnk69D

Small caps are far from a new high. Small caps are expected to seasonally outperform SP500 in Dec & Jan. pic.twitter.com/ljXFJj37go

See how close the SP500 is to making a new high. May was the peak pic.twitter.com/TNxcfN9bsY

Friday’s decline and today’s rally count pic.twitter.com/jfwlnw615J

Possibility is that instead of a significant correction taking place, yellow 5 step could represent only 1st step up pic.twitter.com/Y3X6gBWpYn

Perceived wave count in the NASDAQ. When step yellow 5 breaks its channel, expect a larger correction pic.twitter.com/HZBKvooXl1

LONG TERM = SELL Follow short term tactics with a greater loss tolerance Short Term = Sell Rally peaking wp.me/p1DRwF-332

Oct 2015 – 146 TWEETS

SP500 new highs had been falling on the latest advance, more clues that the market is going to have a correction pic.twitter.com/pXIZn1HZbg

Mike Burk Market has been following 3rd year seasonal pattern with negative bias. Seasonal pattern calls for another week or 2 of strength.

Mike Burk The positives Little reason for exuberance, breadth indicators have not fallen out of bed & seasonality will be ok for a week or 2

Mike Burk The Negative The advance – decline lines (ADL) have been weak and downside volume has remained very high.

Mike Burk The Negative The secondaries continue to underperform, new lows remain uncomfortably high

Mike Burk The good news is: The NDX (Big tech index) closed at an all time high Wednesday.

ES (SP500) sold off at end of day and then day traders covered their shorts for the day. pic.twitter.com/92AEmfd9Z2

JNK is the most liquid (high volume) of the junk bond ETFs. JNK probably illustrates junk bond performance better due to its high volume

Long term look at junk bonds, JNK. They peaked in May 2013 (1st peak) and then again in June 2014 (2nd peak). pic.twitter.com/QTfOy4N7A8

Sudden decline at end of the day. Traders don’t want to hold stocks over the weekend pic.twitter.com/WxUthGuFIR

SOX hit upper boundary of 60 minute envelope & turned downward. Usually indexes stay close for awhile & then decline pic.twitter.com/hSQ9M12TNY

Resistance at upper bounds of 60 minute envelope for NASDAQ pic.twitter.com/HdS9xsnBCa

Is this downward Fibonacci radial still exerting influence???? We’ll see soon. pic.twitter.com/5VdeSwBNX1

Another Fibonacci radial showing resistance areas pic.twitter.com/qMzN6UxEnf

Fibonacci radial that shows resistance areas pic.twitter.com/QJSMW0e9Fw

Good looking purple projection levels for resistance. Peak around SPX 2093 seems likely before correction begins pic.twitter.com/aOBHQ8osTL

LONG TERM = SELL Follow short term tactics with greater loss tolerance Short Term = Sell Rally peaked or peaking wp.me/p1DRwF-332

Terrible recovery that RUT small cap made since late Aug bottom. Large caps are close to highs while others wither pic.twitter.com/nZhoHkq1de

When I say SELL or BUY in the status update, that means picking the best short term spot to execute that order and NOT executing immediately

But after Jan 1 a greater correction could take place, something below red II shown in chart pic.twitter.com/Ber7xhDyXO

Steps 4 & 5 will be possible with a correction that has a higher low than late Sept, stopping above yellow 1 & 2 pic.twitter.com/oi9k9zBfO1

Imagine a deeper correction after 3 & then a steps 4 & 5 to new all time highs on large caps, but smaller caps fail pic.twitter.com/gMMa8DmnOU

I know we have entered the strongest seasonal period of the year and I’m growing bearish. Perhaps we will have a 5 step up instead of only 3

Since late Aug bottom, this is my perceived wave count. Larger correction to begin soon. pic.twitter.com/3oHrPJxznc

Always put your trust in BREAKING THE CHANNEL as to when a wave count has finished. This is always the FINAL ARBITER pic.twitter.com/IuN5DrhlcK

This is really fine tuning the market & can be disrupted by news. Smaller the wave the less trust you should have pic.twitter.com/5ppzkPHrBs

White step 3 will probably be another top in the area of white step 2. Correction to begin after white step 3 pic.twitter.com/V5nLVe84gz

Rally count since late Sept. Market in a longer yellow step 5 that has 1 more step to go (white step 3) pic.twitter.com/h4A59ERmi6

Over the last 2 days, the market has been coming down in a 3 step correction. “Should” have a rally when #3 is fini pic.twitter.com/EqjITRPyvq

Dana Lyons Is the hand-wringing over laggard small-caps justified? Upon inspection, we are still not sure as results were quite conflicting

Equal weight SP500 / Weighted SP500 Strength amongst the few while most are weaker My StockCharts “PAGE 2 CHART 4” pic.twitter.com/mbL6PSHwAd

Tweeted this yesterday & today we’re getting that last step up rally “Rally since late Sept may have 1 more step up & then correct”

Tooting my own horn re: status tweet on 8/26/15 declaring bottom in place. This precision isn’t possible without my wave counting technique

8/26/15 Tweet of bottom in place LONG TERM = SELL RALLY ON APPROACH OLD HIGHS SHORT TERM = VERIFIED BOTTOM LIKELY, RETEST STILL POSSIBLE

Tooting my own horn How many people were warning about a LONG term peak in late April 2015???

Prior to the 4/30/15 Tweet, I had a HOLD on long term holdings, then changed to warning of upcoming long term peak. SPX peak occurred in May

4/30/15 Tweet warning of the future peak LONG TERM = HOLD (long term top forming) SHORT TERM = Short lived rally soon, mid-day Friday ???

SPX Fibonacci radials pic.twitter.com/GLAxJR5wUN

NYSE index Fibonacci radials, resistance on the radials have proven valid pic.twitter.com/1CBsh61Hw9

60 minute chart of junk bonds shows possibility of completing 3 steps up since late Sept stock market bottom pic.twitter.com/W5H1aUIU65

Present rally doesn’t convince me that large step II is complete??? Junk bonds are early warning radar for market pic.twitter.com/wkTADsUiZJ

Junk bonds completed 2 steps up since late Sept bottom. Since June 2014 peak, they have completed 2 large steps down pic.twitter.com/pItp6BUN3H

RUT (small caps) is still stuck. Looks like it completed 3 lethargic steps up. Correction is next for the RUT pic.twitter.com/cBUSNdiDYA

Today the NASDAQ is leading the market higher, SP500 & DJ Ind are lower pic.twitter.com/QXSF0w4CYD

LONG TERM = SELL/NEUTRAL FOLLOW SHORT TERM TACTICS Short Term = Sell/Neutral Rally peaking wp.me/p1DRwF-332

Worst case is that we are in a large correction, 25% or greater Best case, we will bottom above SPX 1867 & rally pic.twitter.com/sALHrTHz2a

Rally since late Sept may have 1 more step up & then correct. Correction will show if we are in 5 step rally pic.twitter.com/XfEzDfPZwr

Waiting to see when yellow “3 fini ?” is finished cuz a correction will take place. Worst fear is red II will start. pic.twitter.com/XunBR2iyBE

Value Line Index (VLI) is unweighted index of all stocks on the NYSE. Adv Dec line of all stocks verifies VLI stasis pic.twitter.com/pBSx2UJ7BP

Future is dreary if small and mid caps don’t play catchup with the large caps. Tick tock . . . . Time is running out

Small caps are static and refuse to rally pic.twitter.com/sMPqn0owVK

Mid caps are static and refuse to rally pic.twitter.com/m3y0FzUACL

Large caps are leading the market, but ONLY the large caps are participating in this rally pic.twitter.com/kFGcDr5zw4

Jeff Saut Corporate revenue growth is still abysmal with only 42.8% of reporting companies beating estimates. Bob Revenue recession???

Lowry’s If an important market bottom occurred late Aug, should be seeing strong trends in our buy sell indexes, but that isn’t happening

Bob says: I’ll be watching how the market REACTS to good news. A good news rally that loses its luster quickly is a warning.

Jeff Saut This week, we look for a trading top, the decline should not be that bad with the Chinese rate cut, FOMC meeting, BOJ’s statement

Jeff Saut We remain optimistic on a longer-term basis, but realize the reality of the Dow Theory “sell signal” has NOT been reversed

Chart shows 3rd step up in the current rally that began in late September. Gotta watch for next significant decline pic.twitter.com/yYcMCARm0u

LONG TERM = NEUTRAL/SELL FOLLOW SHORT TERM TACTICS Short Term = Buy/Neutral Rally Nearly Finished wp.me/p1DRwF-332

Mike Burk The weakness in the secondaries is troublesome, however, new highs are coming to life and the next 2 weeks are seasonally strong.

Mike Burk However, if the secondaries do not improve, this is likely to be a developing top.

Mike Burk We are entering a strong seasonal pattern that is likely to give us new all time highs in the blue chip indices.

Several large cap indexes are bumping on the upper edge of their 60 minute envelope limits. pic.twitter.com/mJNL5qxMKJ

LONG TERM = NEUTRAL FOLLOW SHORT TERM TACTICS Short Term = Buy/Neutral Rally Nearly Finished wp.me/p1DRwF-332

Another look at the wave count using only daily closing figures. pic.twitter.com/GsEhEozWxV

SPX 2065 is the next projected resistance level. 2093 resistance after 2065. pic.twitter.com/gmi4iA6epp

Wave count pic.twitter.com/bqrALWEPMH

A possible wave count for the NASDAQ indicating we’re in last step up before a bigger correction takes place. pic.twitter.com/OTR1KGx52P

Or look at what the micro cap index did today. Some stocks are being left far behind in this rally. pic.twitter.com/oTgw0ksjDK

Look at what the small cap index is doing today . . . NOTHING That’s give pause to think about things pic.twitter.com/Yh9qkF1CbF

@focus1234567 Prices are always prior highs & lows, those are always the important levels Bear market rally likely, but count problems exist

@focus1234567 I want LONG TERM to define the real trend, Short Term should just be a week to week trend.

LONG TERM = NEUTRAL FOLLOW SHORT TERM TACTICS Short Term = Buy Rally Not Finished wp.me/p1DRwF-332

@focus1234567 I think NEW people are confused by my strategy. Every long & short term strategy tweet will have a buy, sell or neutral in it

@focus1234567 Nothing changed. Long term is neutral & short term is a buy today, but could be a sell tomorrow. It was a clarification move

Wave count More to go on the upside pic.twitter.com/CLzVTA663E

More later about wave counts

Only concern is whether I have made the same mistake that I made in MAY 2006. That was a step miscount that gave me a TOO EARLY peak warning

The trendlines shown don’t indicate that the bull market has ended, but the count indicates it’s possibly finished pic.twitter.com/P78qWwvG8X

@wekim77 I ain’t dying, hurting really bad cuz I was so clumsy & fell on my motor home car hitch, thought I broke my hip, HUGE ugly bruise

Life’s a bitch & then you die . . . Meaning I’m hurtin’. I’ll try (???) to keep up with the market & not miss any important observations

Walmart online could compete with Amazon but needs to change online interface & include more bells & whistles. They’re in DISTANT 2nd place

With Amazon I can see in advance (reviews) if the product I want is a dud and should be buying a different model from another manufacturer.

Walmart said Amazon is causing big problems. I don’t shop like I did 10 years ago. I shop online (Amazon) buying EXACTLY the product I want

Bank earnings didn’t cause any problems for Wall St (except JPM), but Walmart was kick in the gut today for the Dow Industrials.

The recent peak came exactly at a predicted resistance level. pic.twitter.com/Od4bWIgUOL

This unusual options trade signals that Wall Street is bracing for a black swan marketwatch.com/story/this-unu…

Bloomberg “the worst commodity bear market in a generation” Commodities are supposed to breakdown AFTER stocks, but not this time???

1st step rallies are significant, while 2nd step rallies are insignificant & 3rd step rallies signal a reversal of trend with a larger rally

SPX has retraced between 50% and 62% of preceding decline. pic.twitter.com/4b4NxsCBxn

In bear market, you never know when we’ve had enough rally from step 1 down. These rallies can carry back to old highs, or only retrace 1/3

Some big banks are reporting earnings in the next 24 hours

It’s possible that step 3 is all part of an extended step 2. After channels are broken, we’ll know for sure. pic.twitter.com/kGjW4Zwri5

A possible wave count with loss of momentum pic.twitter.com/yqXUf3cCB7

Obvious loss of momentum over the last few days in the SP500 futures. pic.twitter.com/ULmlNWchok

@wekim77 About the same, BUT we could get a 5th step as shown in earlier charts. I would not be surprised by another bottom test or 5th step

Jeff Saut Keep your shopping lists close, because if we get a pullback here, it’s going to be for buying as long as 1867 continues to hold.

LONG TERM = SELL ALL, OR SWITCH TO SHORT TERM TACTICS UNTIL FURTHER NOTICE SHORT TERM = DECLINE MIGHT BE COMINGwp.me/p1DRwF-332

That doesn’t look good with the SKEW index at its highest level in a year. Should signal a hefty correction coming. pic.twitter.com/h7NvTrVBIP

Mike Burk Conclusion Sep low had a successful retest of the Aug low. Unlikely market will fall below Aug & Sep lows

Mike Burk The negatives The major indices are up 7% – 8% in the past 2 weeks; the market is overbought.

Mike Burk The good news is: Last week new lows disappeared and new highs began accumulating.

Long term the market is overbought pic.twitter.com/JWrSqv8nFJ

short term the market is overbought pic.twitter.com/54g5dykxym

LONG TERM = SELL ALL ON THIS RALLY OR SWITCH TO SHORT TERM TACTICS UNTIL FURTHER NOTICE SHORT TERM = BOTTOM ON 10/2wp.me/p1DRwF-332

Resistance at top of current W formation (2020), congestion area earlier this year, & peak just before Oct decline pic.twitter.com/X4bdlEGcHx

All morning as we waited for the FED minutes, SPX and DJI are up while NASDAQ has been down (????)

Lowry’s The most frequent months for rallies to start are October and March

US debt doesn’t have much allure for foreign investors. If the world won’t buy our debt, who do we sell it to??? pic.twitter.com/PU9eRgKCYq

Dana Lyons SENTIMENT Assets in bearish Rydex mutual funds hit the highest level in over 3 years…AFTER a 100-point rally in the S&P 500.

Jeff Saut Investors should wait for the middle peak of the W-shaped bottom at 2020 on the SPX to be surmounted before becoming more bullish

Same Fibonacci radial is resisting penetration pic.twitter.com/op1yGktiZn

But other times, my art isn’t worth the paper it’s printed on.

And sometimes, it’s a gut call where art, helps you make the call. I think only decades of experience can possibly give you this ability.

Sometimes other factors help you make the distinguishtion in wave counts. Some times it’s simple because there is only one possibility

OR If we are in this step count pic.twitter.com/uilX0kZKy2

It’s difficult to determine whether we are in this step count pic.twitter.com/0YuynoRc69

LONG TERM = BEARS SHOULD SWITCH TO SHORT TERM TACTICS OR OUT ON THIS RALLY SHORT TERM = BOTTOM CONFIRMATION ON 10/2wp.me/p1DRwF-332

SP futures had sideways correction & NASDAQ showed normal correction. It’s either a 5 step correction, or more upside pic.twitpic.twitter.com/tPW9Dd6N8X

At the moment, the NASDAQ is slightly weaker than the DJI and SP500 and showing signs of a beginning correction pic.twitter.com/maZPpO47WM

Fibonacci radials for SPX, market take a breath here ? pic.twitter.com/poBzDRlwlq

What are corporate profit margins telling us? Nothing good, according to Barclays analysts bloom.bg/1WHWzuc pic.twitter.com/WRyQMmOaNQ

@MikeHren Read the following and it will help explain a lot stock-market-observations.com/2011/07/02/odd…

If the cyan count is correct, there will be a step 5 down. But if cyan 3 was the end, we will continue to rally pic.twitter.com/yHI2DLDPhV

@focus1234567 Some point must represent end of step 1 down in the bear market. This seems like a good point, possibly right, possibly wrong

Mike Burk The persistence of high levels of new lows during last weeks rally leads me to believe it is, or was just a bear market rally.

I’ll see you later pic.twitter.com/r4I50SvJTd

This looks like it has the best price projection of the 3 I posted today. pic.twitter.com/CjbgLqQAmV

Step 3 will probably have 3 very distinct steps within its rally, almost like steps 1 and 2 earlier didn’t exist. pic.twitter.com/nlHL8zLywK

LONG TERM = BEARISH DOESN’T MEAN YOU CAN’T MAKE MONEY SHORT TERM = CONFIRMATION OF BOTTOM PROBABLY OCCURRED ON 10/2 wp.me/p1DRwF-332

Dana Lyons Average retest period following crashes similar to August have bottomed an average of 27 days after the crash…that would be today

Pitchfork for the RUT pic.twitter.com/pPF2wC8KJz

If we don’t surpass peak of 9/16/15, more trouble lies ahead

A forecast for a future peak, we’ll wait and see how things go for awhile though pic.twitter.com/Hk0g4bq40j

NASDAQ is stronger than the DJI or SP, it made new high before correction. The others stopped short of the morn high pic.twitter.com/vW4dNyugfQ

If I don’t post anything, it’s probable that I’m waiting for something (a confirmation) to take place.

Patience is something that you have to learn from the market. I never had it when I was younger, but I learned it was necessary.

If you have established a speculative long position, this is where you sit and wait for the market to prove you right or wrong.

We’ve got to see higher highs. A high above the one on 9/16/15 pic.twitter.com/YKlrjhsYn0

Only the DJ Ind show a CLEAR 3 step down since 9/30/15. Did this represent a successful retest of the bottom??? pic.twitter.com/AOmhaHkil0

How the market reacts to news is always important to market direction. The market could have continued falling all day on this news & didn’t

Bad news today, but the market is climbing back from its initial plunge. Would be encouraging, market closed positive pic.twitter.com/BRIAlBsfOi

A longer term view of the presumed wave count pic.twitter.com/FpMgoZBuQC

This is the presumed correct wave count. pic.twitter.com/7l11IaDhIr

An alternate wave count that allows for higher highs. This count could be valid because of the high number of bears pic.twitter.com/Jv83tq9xlU

Sep 2015 – 89 TWEETS

The SKEW index fell today moving it into a comfortable range for a rally to continue pic.twitter.com/kMpUNxWS49

LONG TERM = BEARISH OUTLOOK FOR NEXT YEAR, OR LONGER SHORT TERM = WATCHING/WAITING FOR CONFIRMATION OF A BOTTOM wp.me/p1DRwF-332

Was that a successful retest of the panic bottom? The count is right, but we’ll know for sure with higher highs pic.twitter.com/pI5ZWQlqMp

LONG TERM = BEARISH OUTLOOK FOR NEXT YEAR, OR LONGER SHORT TERM = WATCHING/WAITING FOR A BOTTOM IN STEP 1 DOWNwp.me/p1DRwF-332

Bulls are down, but bears don’t look like they’ve capitulated by rising to a higher level. It’s all relative though!! pic.twitter.com/IQdLIZrBr4

Lotsa bears running loose pic.twitter.com/f1POZT8fIJ

Aug 24 low is support(??) Some indexes have already penetrated. It’s HOW the market acts after/if SP500 penetration pic.twitter.com/WMmmpwGFOQ

Wave count for NASDAQ. Step 3 marked the bang and now we wait for the whimper. But if we’re going down in 4 & 5 . . . pic.twitter.com/1G6838526U

Fibonacci lines for NYSE index pic.twitter.com/bYxWtuJY9r

Another Fibonacci price projection based on 2009 pic.twitter.com/W0K4sR6faY

Fibonacci price projection based on 2009 pic.twitter.com/1lNIjngoFa

Haven’t shown this chart in recent weeks pic.twitter.com/q4gIZFjCpe

Dow Industrials are down about 23% of advance since 2009 pic.twitter.com/UE3dc7U5rk

A “possible” long term wave count pic.twitter.com/J5j9r5vpHG

Another 2012 based pitchfork pic.twitter.com/iwDOjJEvxy

Another pitchfork pic.twitter.com/15cSaZviHt

Pitchfork based in 2012 pic.twitter.com/joDXA61vLv

#2 Continuation of pitchfork in prior tweet pic.twitter.com/u0Bv6isk92

#1 Pitchfork points in early part of bull market pic.twitter.com/YTxzSI8yFl

Long term pitchfork for the Yen pic.twitter.com/vMJwvvLTx1

A longer term look at junk bonds pic.twitter.com/zzSb3AVeM2

Spell check plus not proof reading my tweets closely is causing havoc with me today. I gotta an excuse, I’m old

Market declines end with a bang or a whimper. We’ve had the bang & now we could see a whimper Whimper would consist of aimless action days

Part 2 Ralph Bloch of Raymond James pic.twitter.com/U3Jk0uhB6o

Part 1 Ralph Bloch of Raymond James pic.twitter.com/ZLcOFF1LyQ

Monday was a 90% down day, 90% declining stocks and 90% declining volume. pic.twitter.com/eVMg7dp5qR

BEAR MARKET DOESN’T PRECLUDE NEW HIGHS Not saying it’s going to take place, but we could rally & have TOKEN new highs in a step 4 & 5.

LONG TERM = BEAR MARKET DOESN’T PRECLUDE NEW HIGHS SHORT TERM = AT SOME POINT WE SHOULD SEE A RETURN TO OLD HIGHSwp.me/p1DRwF-332

Interesting chart on market count. If valid, it could set up biggest rally since market peak. pic.twitter.com/ioiOYqfrPV

@focus1234567 Nice to be back, but need to rest from vacation. Gonna do nuthin’ but watch DVR for while. Trees blocked satellite reception

Lotsa analysis needed to figure out the count.

SKEW index is still high & usually means more downside, hard to reconcile that with the need to rally pic.twitter.com/pLz1DnNS1V

Price is on the edge of the envelope, which could be a rebound area. Market is oversold & could rally pic.twitter.com/Imwu74oKqf

Interesting trend lines. pic.twitter.com/ISm8ulOKCk

Been on the run for 28 days & 4700 miles. Glad nothing happened in the market while I was gone. Gonna take a while to get me up to speed

There should be no doubt in anyone’s mind that the market ended step 3 up in late June 2015. What are the market’s possible scenarios?

SKEW index is volatile & spending lotsa time at high levels. High SKEW reading is indication of a likely correction. pic.twitter.com/xK4BMcMOkP

Jeff Saut There has been only one false Dow Theory signal in the last 18 years, at least by my method of interpreting Dow Theory.

Jeff Saut We are trying to stay constructive, but the negative evidence is mounting

LONG TERM = SELL RALLIES, RALLIES APPROACHING HIGHS SHORT TERM = BEAR MARKET LIKELY AFTER RALLIES HAVE NO MONEY LEFTwp.me/p1DRwF-332

I’m one of those narrow minded nuts that never got on board with globalism. I don’t like exporting the USA’s wealth to the rest of the world

FTSE & DAX have lower highs. This is looking like a world-wide phenomenon. The world is in sync & I don’t like that!! pic.twitter.com/bEXE7kCBDy

Notice how the recent high was turned back by the lower pitchfork resistance line pic.twitter.com/OKJv3MpHxB

Really need to see my Sierra Charts (black background). I’ll see if I can update them tonight and post a couple?????

Closing break of SP500 @ 1914 MIGHT challenge panic low. SIGNIFICANT closing panic low break “might” be bear confirm pic.twitter.com/HTZbAzCTTY

I see 3 steps up in latest rally, looking like it finished 2 larger steps up. Watch for closing break of SP500 @ 1914 pic.twitter.com/TfiL16EPVC

John Murphy WITH SHORT-TERM BOUNCE ENDING, A RETEST OF SUMMER LOW APPEARS LIKELY, THIS WILL HELP DETERMINE IF THIS IS A CORRECTION OR BEAR

John Murphy FED INACTION BOOSTS BONDS AND SAFE HAVEN ASSETS WHILE HURTING STOCKS

Mike Burk The negatives Market has been following average seasonal pattern quite closely and that pattern has been down for the next 2 weeks

Mike Burke The good news is: The secondaries continued to outperform the blue chips. Yup, that is good news Bob

Important lower lows, not little ones within a small correction. Gotta run, creeps with straitjackets discovered my hideout. Woe is me

Nice rally though, but I hope that isn’t the end of 3rd step up. Gotta watch for an unusual retracement or lower lows pic.twitter.com/tJgDxeqTqt

I’m still on the run, those dastardly guys in white coats haven’t caught me. I ain’t goin’ back to the joint. They’ll never take me alive

Mike Burke Conclusion New lows have declined, but haven’t disappeared as typically do coming off bottom making me suspicious of recent rally

@wekim77 duhhhhhhh . . . They have me on low oxygen & it’s hard to think of my name or anything else. Mean bastards will resort to anything

Going back into the land of no signals, so hang tough. Poor Bob

Here come the guys with the straitjacket to put me away. Gotta run & make good on my escape Tune in to see what happens to poor Bob next!!!

My long term outlook is still the same. That picture HAD been developing for a long time & is only subject to tweaking. Like extensions 😦

I’m living in a dungeon & my signal is non-existent for long periods. I’ll yak when the guards permit me (between shock treatments) 😉 LOL

Tactic 1 sell the rallies, Tactic 2 wait for new highs, could be weaker steps 4 & 5 from 2011. Whichever tastes better is the best pathway

Higher lows dominate the picture & higher highs look to be in store. pic.twitter.com/Pl8jEDakQ4

The Skew is in a high zone that precedes market declines. Fast run up on the Skew, looking like last Oct run upward pic.twitter.com/CcCNfNzXOf

Investors Intelligence bulls at lowest level since 3/2009. VERY bullish situation & gives credence to a rally back to old highs (or more).

Ryan Detrick “Lately though, when the first day of any month drops big, the rest of the month soars back up 6% on average” ??????

Ryan Detrick “Sep is weakest month going back to 1928. I found when 1st day drops 2%+ (like it did), rest of month tends to be very weak”

Gary Kaltbaum: “It is quite noteworthy that markets cannot get a head of steam considering the oversold condition.”

My scenario is a successful retest of panic Monday low, followed by rally to old highs. Failure to make a new high, market rolls over & dies

LONG TERM = SELL RALLIES & ANY RALLY APPROACHING OLD HIGHS SHORT TERM = BOTTOM #1, RETEST LIKELY, BEAR MARKET COMINGwp.me/p1DRwF-332

Mike Burke . . . We may be in for a real bear market and not a short term correction. OVERALL Bob agrees with Mike Burke

Mike Burke Conclusion Markets lack of responsiveness to sharp decrease in new lows leads me to think . . .

Mike Burke: . . . but that appears not to be the case this time.

Mike Burke: The negatives Over the past 2 weeks new lows have practically disappeared. This usually indicates a bottom for prices,

Mike Burke: The good news is: · Hard to find.

No lower low today, so it “could” be an uncomplicated double bottom . . . But things happen. More rally seems likely. pic.twitter.com/65M4BtFA71

Lotsa red in the world stock markets today, so this not a localized phenomena pic.twitter.com/y75qaYN5co

My long term prognosis is unchanging and is my guiding observation. It’s the “or worse” part of long term that I worry about.

Wish could post charts to explain things clearly, but that isn’t possible at the moment. Damn!!! See my charts on StockCharts listed in bio

Remember how retest goes, they can be the same, higher or even lower than initial low. Worst case scenario is we’re in a larger step down!!!

Looks like a retest of panic low is in progress. Step 2 down of 3 steps down, but until we break low of 4 days ago, step 2 isn’t verified

Projection chart have a common level at 1985 (purple and yellow). We’ll see if it’s meaningful.

Good night and good luck . . . ERM and Bob

Fibonacci projection levels, purple are downside that are still providing resistance, yellow is upside projections pic.twitter.com/AXF3pdzQNK

“Good night and good luck”. – Edward R. Murrow and Bob

Gotta weak signal, hopefully tomorrow will yield stronger signals to do constructive things. Lack of communication DOESN’T CHANGE my outlook

Need a Fibonacci projection chart for this rally. I’m writing this on my iPad & it can’t do stuff like that. Need Sierra Charts on MacBook

Nice well contained decline & blasted off into step 2 today. This is all part of the rally back towards the highs. pic.twitter.com/gTeIMjE7gl

Had 3 steps up since low near yesterday’s close. Declining presently & we’ll see what it’s going to do on decline pic.twitter.com/Fah68Eow1g

Maybe in 4th step presently, have to wait for a bounce or a decline to tell us more pic.twitter.com/rGWITIoVrI

Sometimes all the fun is in step 3, which is exactly what happened beginning yesterday after the close.

Aug 2015 – 507 TWEETS

Starting Tue, likely fewer tweets for Sept. Will anyone notice?? If dramatic events take place & I don’t comment, it’s cuz I lost my signal

LOTS of chatter on Twitter from smart stock market guys that are dwelling on China. I think R problems are broader & more complex than that

How A Real Plunge Protection Team Works—–China Rolls Out The Paddy Wagons, Snatches 200 Rumor-Mongers davidstockmanscontracorner.com/how-a-real-plu…

Said before that Jeff Saut is a strategist that I pay attention to. When we disagree, it’s minor, or the disagreement doesn’t last long.

Jeff Saut is ignoring Dow Theory sell signal for now. He’s playing rally back to old highs, or beyond. He is still VERY leery of more lows

When I see LARGE 3 completed (since 2009), I get very wary of the future. Sub-stepping can always throw a money wrench into the pile though.

Market could still trace out a 4 & 5 up this year before the real decline begins, but I don’t HOPE for things like that. I play risk reward.

I regret not calling heavier reductions of long term positions at the May peak. I only said sell underperforming stocks. Hindsight is 20-20

SP500 futures down -28 points tonight & DJ Ind down -210. Another gap opening unless things turnaround.

Can’t discount the “possibility” that a retest could be underway. Gotta be swift to take advantage, or avoid problems pic.twitter.com/DRecn8Ldlb

3rd step down is obviously underway, if we don’t have any sub-divisions, should be over in a reasonable time period pic.twitter.com/vdlnrxrvjP

LONG TERM = SELL . . . RALLY “ON APPROACH” TOWARDS OLD HIGHS SHORT TERM = VERIFIED BOTTOM, RETEST POSSIBLE, OR WORSEwp.me/p1DRwF-332

My blog tells you all about my wave counting voodoo (& other things that aren’t voodoo). Blog is not updated anymore. pic.twitter.com/pXEZODaHYi

Each wave count was contained in a defined channel, or slope. Each break denoted another wave, or end of decline pic.twitter.com/xGwldWoP9u

Lotsa sub-divisons in this chart, but it’s well contained close to the rally peak pic.twitter.com/qCcimdMPsr

“IF” white 3 is finished on downside meaning no sub-divisions are going to take place, we are in store for more rally pic.twitter.com/nDciD2CF5K

LONG TERM = SELL – RALLY ON APPROACH NEAR OLD HIGHS SHORT TERM = VERIFIED BOTTOM LIKELY, BUT RETEST STILL POSSIBLEwp.me/p1DRwF-332

Is this 2 steps down? It looks like it & might be rolling over into step 3 down? It’s a reasonable correction so far? pic.twitter.com/s0MqAtmAY7

Fibonacci projection lines are working well. These were downside lines, but are working just as well on the upside pic.twitter.com/viMtUB7G3C

If don’t reverse before tomorrow’s opening, we’re going to have another gap open. Last Monday had a bad first 15 minutes (down 1000+ points)

SP500 futures down -26 tonight & -211 D Ind. Multi-step down since peak on 27th. Probably in 2nd step down since 9/27 pic.twitter.com/XO3n92qepA

The entire Mike Burke update for 8/29/15 …arketobservations.files.wordpress.com/2015/08/mike-b…

Mike Burke Intervention on Mon & selling stopped, weakness needs to resolve itself, takes longer than if the market was allowed to crash

Mike Burke All of major indices positive for week, not led by the small caps or accompanied by a significant increase in number of new highs

Mike Burke 336 new lows on NYSE Mon, 41% of issues traded & 772 on NASDAQ, 26% of issues traded. Retest follows numbers of this size.

Mike Burke The good news is: · New lows disappeared at the end of last week.

A good article by Martin Pring (author of many good stock market books). BP% of SPX can be found on my StockCharts …arketobservations.files.wordpress.com/2015/08/martin…

90% down day on Mon & then almost had a 90% up day on Thursday. Advancing issues were 87% & up volume was 96% on Thu pic.twitter.com/5OZj8AfeJM

Markets gonna keep it a secret as to whats next. After a 3 step down late today, did a FAST rally to below prior high pic.twitter.com/4upoKNDqOz

More upside before a retest of Monday bottom. A POWER thrust thru Mon low with volume & not stopping is bad voodoo wp.me/a1DRwF-2Le

Waiting for lower low, or possibly higher highs. I guess not many want to hold open positions over the weekend. pic.twitter.com/yFfUaSWugX

Duhhhh, some day I’ll learn . . . but I’m old, I have reasons to be stupid Read all of Tom McClellan post …arketobservations.files.wordpress.com/2015/08/10.pdf

#8 and going to live in a commune. A bear market does not depend on the ultimate magnitude, but rather upon the attitude it creates.

#7 market is when most stocks do poorly, even the most deserving ones. It hurts everyone. It gets people talking about giving up investing

#6 A bear market is nearly the same, except that there are lower highs and lower lows for a protracted period over several months. A bear

#5 higher highs & higher lows on an intraday chart, but that does not make it a bull market. There needs to be persistence for a long time.

#4 prices make higher highs and higher lows. A bull market should be thought of as lasting over several months at least. You can see

#3 A bull market is when the major averages are in an uptrend, and most stocks are doing well. An uptrend is defined as a period when

#2 McClellan It is among the most meaningless, useless, and untrue statements out there. I agree COMPLETELY with Tom. BETTER DEFINITIONS

#1 Tom McClellan I’m starting personal crusade to expunge notion of “10% is a correction & 20% is a bear market” from our collective lexicon

China A shares were up 10.3% today. A serious rally after having declines of similar magnitude. H shares (less volatile) were up 1.8%

End of 3rd step mentioned earlier, had immediate correction & rebound to new highs. We MIGHT still be in 2nd step up? pic.twitter.com/Cd4bTe66iy

It’s possible we may be ending 2nd step up since 8/25. I can see 3 steps since 8/26 which encompasses all of 2nd step pic.twitter.com/oZCR0sXEF3

Since rally began on 8/25, appears that we are 2nd step up, which will be followed by a correction & then step 3 up pic.twitter.com/awquCWkWdd

Jeff Saut looking for move no higher than 1970-2000 SPX. We are in that zone presently. He looks for a retest after this move up is finished

Soon I will write fewer tweets as I’m going to be busy doing other things for awhile. I should be doing at least 1 tweet per day.

Good night John Boy. (Weird . . . told you my mind works differently) As Bob says good night too. It’s only 12:30 AM on west coast

Successful retests usually accompanied by strong move up on high volume. Retests 1st few days after initial bottom are part of reflex rally

Retests of prior lows can end at the same level as the first bottom, OR at a level HIGHER or LOWER than the first bottom.

#2 John Murphy That assumes of course that this is a market correction, and not the start of a major bear market.

#1 John Murphy Any bottoming process this year could last at least a month or two and will most likely include a retest of recent lows.

Last time McClellan oscillator was this deeply oversold was May 2012

China A shares are up 3.25% tonight. A shares are the most volatile. The H shares are up 2.65% tonight.

If don’t understand how I count the steps in the market, read the explanation found at this link. stock-market-observations.com/2011/07/02/odd…

SP futures are back at the overhead resistance level that has turned the SP futures back two previous times. pic.twitter.com/wvZYmwBcy5

It’s Bernard Baruch, not “Bernad Baruck” One of the smart guys of a by-gone era. Sold early in 1929 & went to Europe. Missed crash of 1929.

Missed calling top correctly in 2007, called it early instead of Oct 2007. Vowed not to make that mistake again, so I waited & waited . . .

I shoulda done this . . . but didn’t Shoulda called a top in the market many weeks ago as I was becoming wary & urged long term liquidation

After large step 3 since 2009 completed 1) rally into tepid steps 4 & 5 up 2) decline in 3 steps down (30%) 3) decline in bear market (60%)

Another less agreeable guess Rally awhile & then decline past the recent lows The tone of the market has now changed since step 3 completed

Another guess Rally & make token new highs & then decline. We could repeat this two times, making token new highs (steps 4 and 5 since 2009)

Best guess Build some kind of base and then rally toward old highs, but fall short, roll over into a larger step 2 down.

But I’m not Baruch, so I’ll hazard a guess. We’re going to stay in the “general” area of the low before mounting an attempt at higher highs

Yeah, yeah, yakety yak, yadda yadda yadda . . . enough. What’s next? As Bernad Baruck said so eloquently many years ago, “it will fluctuate”

Fibonacci retracement since 2009 has stopped at 23.6% and on one of the upward trend lines based on 2009 bottoms. pic.twitter.com/OMNiIB3pk9

We had a strong close on EVERYTHING today.

Dow Theory sell means investors have to be careful until next buy signal is given. Buy signal doesn’t occur for several thousand points up

Dow Ind & Trn showing violating their closing October lows. giving a Dow Theory sell signal pic.twitpic.twitter.com/6crVNQKy6e

SPX almost inside the envelope which defines normal behavior. A few indexes are already inside their envelope pic.twitter.com/09LDqE3Vwh

All 4 of these indexes show inside days (yellow) for the last 2 days, SPX, DJ Ind, NASDAQ Composite, NYSE Index pic.twitpic.twitpic.twitpic.twitter.com/jE12xyuhrB

Russell mid cap showing good wave count. It’s difficult to find consensus wave count. Some indexes show 4 steps down pic.twitter.com/D0mQv7SMRn

Busy all day baby sitting the RV at the repair shop

LONG TERM = SELL RALLY ON APPROACH NEAR OLD HIGHS SHORT TERM = VERIFIED BOTTOM LIKELY, BUT RETEST STILL POSSIBLEwp.me/p1DRwF-332

John Murphy favorite, above zero line is a bull market, below zero line is bear market, could be a fake out like 2011 pic.twitter.com/rpcqEBpwXk

5 day Trin is showing a very oversold reading pic.twitter.com/9qKUArcJwj

SP futures made lower low after the close, close is 13:00 on this chart, if it continues doesn’t bode well tomorrow pic.twitter.com/P0MExvzB7L

SPX made a lower closing low today than yesterday’s close pic.twitter.com/6mZun309ql

Russell 2000 (RUT) made a lower low today. Everything else closed weak. pic.twitter.com/ffRF57wPt4

Earlier called this step 2 up, looks like the 3 bumps since the low were the 3 steps up. Retest, or worse in progress pic.twitter.com/qLbggkdNQG

Purple Fibonacci radial step 1 down in May, Yellow Fibonacci radial step 2 down in Jul/Aug Converged on yesterday low pic.twitter.com/XD35s7nnqW

New Pitchfork, too steep to last very long, but it’s probably in force until broken pic.twitter.com/vxrfmXWC1i

If we make up our mind about what happens next, it is impossible to keep our ego at bay if the market goes the other way. Kills flexibility

After Oct penetration of envelope, buying panic took place to all-time highs, a buying panic now would be a surprise pic.twitter.com/Qd5paulPno

Well . . . I’ve beat the high frequency traders to death, so I’ll get off my soap box

Restrictions on high frequency traders won’t happen until LARGE event occurs, can’t expect the SEC to be on the ball pic.twitter.com/ooo3JOvOxW

Gotta put restrictions of some type on high frequency traders so they can’t make declines worst than otherwise pic.twitter.com/n0cMfkxm8L

High frequency traders fault, not useful, provide liquidity yes – until a downdraft occurs then exacerbate declines pic.twitter.com/XHnIGabMQ2

No 2008 envelope penetrations were as large, so this was an unusual event pic.twitter.com/tUdcvjN84T

Last penetration of extreme size was after 9/11 when markets reopened after being closed. 9/11 was a larger % down pic.twitter.com/fPrw2kjgfc

Extreme penetration of envelope that keeps normal fluctuations within envelope, penetration means rally is coming pic.twitter.com/XFSsz40kti

ADX is still in the buy range after being in an extreme yesterday morning pic.twitter.com/hbCnDTbUBZ

Short sale restrictions in effect for Apple. Usually means they can’t find enough stock to fill all the short sales pic.twitter.com/WsakIq5rLz

Dow Jones Industrials and Transports have been among the weakest indexes. Only a few indexes broke the Oct 2014 lows.

None of the Russell indexes penetrated the Oct 2014 low, large cap, mid cap, small cap, micro cap pic.twitpic.twitpic.twitpic.twitter.com/yKuf3kOMwW

SPX never broke the Oct 2014 lows pic.twitter.com/geeDJ13Xbn

LONG TERM = SELL RALLY TO OLD HIGHS OR WHEN COMFORTABLE SHORT TERM = IS CRASH OVER, NOT UNTIL SEE A VERIFIED BOTTOMwp.me/p1DRwF-332

Daily wave count pic.twitter.com/dm0mO0xjoQ