12/5/13 – Investor Evolution, Value Investing, Sequoia Fund, Jeff Saut, Jim Rogers, Bear Markets, Edson Gould, Is Large Step 3 Down A Myth???

12/5/13 . . . by Bob Karrow

——————————– SECTION ONE ——————————–

WAVE COUNTS

- If you aren’t familiar with my unorthodox wave counting method, there is a simple explanation (KISS) at the beginning of the glossary. The glossary also contains ideas and details that don’t appear in the blog.

CHARTS

- Page 1 – of my charts have wave counts that begin with the bear market bottom of 1974 (monthly, weekly and daily charts).

- Page 2 – of my charts have indexes with shorter time scales. Channels and wave counts “may” appear on this page.

- Page 3 – of my charts is the beginning of many indicators that show the general health of the market. Don’t let them confuse you, just watch their trends. Some consist of oscillators where you watch for overbought or oversold extremes.

- Some of these indicators have the ability to predict future market action. The more interesting indicators will have an * in the title bar.

TWEETS

- My tweets are frequent and my blog updates are infrequent.

- Tweets are very short and may contain a link to a chart that will explain my point.

——————————– SECTION TWO ——————————–

The blog from Hell.

One subject leads to another, which leads to another . . . blah blah blah. Also, I get up each morning and reread the preceding days edits and don’t like what I had written. Reading with fresh eyes, I would find convoluted thinking that readers would find confusing. Being anal, I had to rewrite endlessly. As I said this is the blog from Hell or maybe my OCD is in hyper-drive.

But if I can’t make myself clear, the blog is useless. I think it’s finally finished and this particular blog made me appreciate tweeting where I’m limited to 140 characters.

————————–

I have spent most of my life studying market direction. I held the theory from an early age that on occasion:

It can be more important WHEN you buy or sell, than WHAT you buy or sell.

Regardless of investment quality, I didn’t like holding stocks during a bear market because everything went down at some point during the bear cycle.

When I say bear market, I’m referring to a significant decline that lasts longer than a year. The length of time of the corrective process is a significant component of a bear market. (More on bear markets can be found in Section Nine of today’s blog)

Unfortunately the ability to predict a bear or bull market would see a lot of years pass before I knew a major market turning point was coming. Many thanks to Edson Gould for teaching me perspective and the importance of studying the psychology of people and the “crowd”.

Before Edson Gould’s teaching, there was a long and tortuous learning process. When the learning process was painful, I always asked myself, what did I do wrong, what can I do to correct this mistake and not repeat it.

The beginning of my learning process started in 1955 as I questioned my grandfather about his investments in utility stocks for their dividends. He gave me my start on understanding how the investment process worked.

In 1955 computers were machines that filled a refrigerated room and only the government could afford to buy one. It would be another 23 years before I had my first computer (1978) and could chart and study stocks by machine. One important point regarding charting stocks by computer, it will cause you to lose an edge that can only be found charting by hand. Try charting by hand for at least 6 months and see if you can tell the difference. You’ll find that you’ll get in sync with the stock as you chart by hand.

In 1955 I was too young to have my own brokerage account and I had very, very little money. I was a typical broke 14 year old kid, but I had some crazy ideas. I convinced my father to open a brokerage account and I pooled my tiny amount of money with him. After I did the research on a group of stocks, my father would usually agree with my suggestion to buy a particular stock. The stocks we bought were usually high flyers. But the high flyers drove my father batty because of their high volatility. From prior observations, I knew that stocks that went up 7-10 points in one day were going to lose a big chunk of that back sooner or later. I understood all about zig zag as a normal stock market process (observation taught me). One stock we owned was Lukens Steel (imagine a steel stock as a high flyer, different times folks). It had a strong uninterrupted run over many days of sizable upside points, and then it lost a big part of that gain all in one day. My father thought the world had ended and he sold. Lukens Steel subsequently soared far above his sell point.

After Lukens Steel I was convinced that I had to control my own brokerage account. I saved all my money from my first real job (Jack in the Box) and my father opened another brokerage account (still in his name because I wasn’t legal age), but I had complete authority over this account. The account had only my money and it was mine to make or break. This was the independent beginnings of my investing career.

In the fall of 1957, the first stock I bought for “my” account was Ampex (they invented the video tape recorder). I bought it after it had split and paid $44. It promptly went down to $40 and sat there for several months. What a dud. It just sat there plus I had a small loss. What did I do wrong??? Then one day it jumped several points, did nothing for a couple of days and then jumped again. This trend kept up for months. Naturally there were the normal zig zags, but before long Ampex was going parabolic. I sold it in the first half of 1958 at $120 and bought my first car. Hot stuff, I’m 16 years old and I bought a 1 year old car and paid cash. Ampex kept soaring and splitting, but I was happy with my car.

WOW! This is so easy.

Why should I ever work again. I can buy and sell stocks the rest of my life and before long I’ll have more money than I know what to do with. Why aren’t other people doing this? I guess they just didn’t have my “talent”.

I had committed one of the great cardinal sins of Wall Street:

“NEVER CONFUSE GENIUS WITH A BULL MARKET”.

It’s so very easy to confuse genius with a bull market. I personally knew a lot of geniuses during the late 1990s. They all thought I was nuts warning them about an ending to the 1990s bull market. They knew far more than I did, because they were stock market geniuses and I wasn’t. Yup, it’s real easy to fall into that trap.

Meanwhile during my teen years, I did learn that there was a downside to stock market investing. I wasn’t a stock market genius anymore, I had just been lucky and now reality was hitting home. The bull market had hit the pause button and I wasn’t told about it.

In later years as I gained more knowledge about the stock market, I developed a few rules. I was still a trend follower (aka crowd), but I had some discipline.

I would buy a stock with high growth prospects (usually a company with no competition and a great product, utilities didn’t fit my profile). I also looked for sponsorship (persistent buying volume). I would hold the stock as long as the growth prospects remained intact and the company’s price and volume showed nothing unusual. I favored a stock that could stop its decline by going no deeper than the prior correction’s peak. Unlike some investors, I watched my stock very closely and usually knew when it was acting right or wrong. I always charted the stock’s daily price and volume by hand. If the stock held to my best case scenario, I employed a strategy of margin pyramiding.

Margin pyramiding is a strategy that can only be used successfully when “It was the best of times, it was the worst of times”. (borrowed that one from Chuck D.)

If you are unfamiliar with the term, margin pyramiding, hopefully the following example can clear the fog.

A margin pyramiding strategy is an investment approach with higher risk, but with proper money management it can produce great results.

During 2008, the market collapsed with only a few small upward corrections. If a trader was short in this type of market environment, it would be a prime candidate for margin pyramiding. In the below chart, Citigroup took a beating during 2008. In a pyramiding strategy the trader would add to their short positions on each upward bounce using the paper profits in their margin account. Paper profits exist as real money in your margin account (ask your broker). This process of adding to your short position with your paper profits would have continued down to the bottom in March 2009. The end result is this would have produced much greater returns than simply shorting the stock at the peak and riding it down in a single trade..

The only problem using this technique is that it raises the level where you can receive a margin call. But I used this technique for years without a margin call. Picking the right stock and the right timing was extremely important, otherwise you could easily be in trouble.

Margin pyramiding was my first introduction to higher leverage than conventional margin. I don’t remember the year that I first used this technique.

When I began investing in the market, margin was 70% and it has fluctuated considerably through the years. It’s been unchanged at 50% since 1974. Looking at the margin rates and dates below, the present 50% rate has been unchanged for almost 40 years. Prior to 1974, margin rates had been changed every couple of years.

Before the early 1970s, there were no exotic stock market products, such as index mutual funds, index ETFs or stock market index futures and their options. There were individual stocks and that was it.

During the early 1970s, I read an article about the Coral Index based in London. Coral was a gambling establishment that was taking bets on the direction of the Dow Jones Industrials.

The following is not the initial article I read, but it gives you a general sense of the Coral Index in 1971. There are several errors in this article.

Click to enlarge

The next article explains that the maximum bet was 1,000 pounds.

Coral Index article from the New York Times, February 18, 1978

LONDON BOOKIES TAKE ON STOCK MARKET, The New York Times News Service, LONDON — It is one of the most frustrating things in the stock market, you “know” it’s going up, but you don’t buy because it would be just your luck to pick the one stock in 20 that would head straight down.

You will have called the market right again — and still not be making money Well, there’s help for you. A small, little-known company takes bets on which way the Dow Jones industrial average will move. No more risks of buying Penn Central or Equity Funding. No more commissions or advisory fees to pay. No more tying up all your capital. All you have to do is pick up the phone, dial 011-44-1493-5261, and ask for Christopher Hales, the stock market’s Jimmy the Greek. Hales and his two associates here are market bookies, employing the point spread and their wits against the punters of the world. “It’s a gamble — you can’t get away from that”, said Hales, a 38-year-old former stock market and commodities operator, who looks as if he would be as much at home in the lofty reaches of the Bank of England.

Here is how it works. You buy or sell “lumps” of the Dow Industrials, composed of 30 leading issues on the New York stock Exchange. The minimum is two one-pound units ($3.90) and the maximum is 1,000 units ($1,950). If you buy and the market goes up, you will probably make money. You will also win if you sell and the market falls. Like all businesses, Hales’s company, Coral Index Ltd, needs a profit margin. It creates this by making a 10-point spread between its buying and selling prices, usually straddling the current level.

Last Friday, Jan 27, for example, the Dow closed at 764 12. Coral opened its quotes Jan 30 at 760 for sellers, 770 for buyers. If you bought, say, 10 units at 770 and the index jumps to 810 you would make 40 x 10 pounds, or 80 pounds. You don’t have long, however, to be right. No bets last more than 30 days “We reckon the Dow won’t often move more than 50 points in a month.” says Hales, noting that the relatively short period tends to keep its own and customers’ losses from getting out of hand. It also allows Coral to keep slicing away with the spread though Hales insists this is not the biggest factor in its profits. “What we’re really relying on is that the average investor is going to be more wrong than right.” The spread helps us to balance the book and gives us enough to cover the overhead.

All transactions are made by phone; the mail is considered too slow, too unreliable and in some places of dubious legality. About half of Coral’s business is in the Dow Industrials, with the rest in the Financial Times of London’s industrial ordinary index of 30 British stocks. The spread for the London market is five points because of its lower level.

Coral, operating from a second-story office on fashionable Berkeley Square, began taking bets on the Financial Times index in 1964, adding the Dow in 1967. It didn’t attract much interest, however, until the 1970s. and even now only about 100 customers of the 6,000 are Americans, many living overseas. Most customers are brokers or others with close ties to the market, some hedging positions in options or stocks. Swiss money managers are frequent players. (Bob’s note: I didn’t realize that I was only 1 of 100 people in the USA that was dealing with the Coral Index. I only realized this when I found this article for the blog.)

Coral says: There are also nonprofessional bettors in the United States, Europe, and Australia. If you are a really high roller, say $40 a point and up. you can telephone Coral collect. You can also haggle about the price. Although the company does not guarantee to take more than 100 units, you can probably negotiate higher stakes, perhaps at a higher spread. Hales says there are a few people who win consistently. They are not particularly unwelcome, he says, since they help Coral adjust the spread, which in a volatile market may change 20 or 30 times a day. One reason Coral thinks most bettors will be wrong is that they are usually playing with their own money and thus tend to make mistakes under stress; the “house.” using corporate funds, can remain calm.

In the early days. Coral would often partly hedge its position by buying or selling some shares. But it couldn’t improve its performance this way and now unlike most bookies it does not lay off any of its risks. “We don’t hedge anything, ever,” Hales says.

Sometime in the early 1970s (I forget the exact year), I opened an account with Coral and began betting on the direction of the Dow Jones Industrials.

I would call London several hours before the New York Stock exchange opened and place my bet. I never made a bet unless I thought a market turn was imminent and probably significant. I spent a great deal of the time without a bet, but that was fine because winning a bet had a high return.

It was kinda funny when I called to place my bet because there would always be a flood of bets going in the opposite direction of my bet. This helped me considerably because I would be given a very favorable spread in the event of a market turn. This was due to the heavy betting pressure in the opposite direction of my bet. The spread always follows the crowd and keeps it harder for them to win.

During a quickly declining market, Coral would create a spread that was heavily biased to the downside. This is how the house tried to put the odds in their favor. Without a favorable spread for the house, Coral could be out of business. Due to the high negative spread, the market had to fall a fair distance before your short side bet would be profitable. But if you placed a long side bet during a high negative spread situation and a turn took place, your profits were instantaneous and greater than normal.

For instance: If the Dow Industrials closed yesterday at 850 and had been falling steadily with increasingly heavier downward pressure, you would receive a price around 830 for a short and 840 for a long. Playing for the turn, I would buy a long at 840. If the market rallied 20 points over the next week to 870, my profit wasn’t 20 points. It would be 30 points (870 – 840 = 30). This was because I received a 10 point discount from the prior close when I placed my long side bet. That gives you an idea of how the spread pressure could work in my favor.

I remember one occasion in particular when I had bet long and received a very high 20 point discount from the prior day’s close. This was due to the huge downside selling pressure. Remember during this period of time, the Dow Industrials price level was always less than 1,000, averaging around 800-850. 20 points at that time represented approximately 400 points in today’s market.

In many ways, the Coral bets had the same significant problem of an option, TIME. Time was constantly your enemy because the bet only lasted 30 days. You only had 30 days to overcome the spread. For this reason I would only bet when there was a significant chance of a turn. Because of the time factor, my money usually was sitting in a bank in London.

I never had a loss during my time with Coral and this had been noted by the people that I dealt with. I was always taking an opposite position against the present market trend and this made me an unusual client at Coral. Along the way, I had some interesting conversations with Coral.

But things changed when another opportunity arose. In 1981 the Kansas City Board of Trade introduced trading in a stock index futures contract based on the Value Line Index. The leverage was quite high and the initial margin was low.

The following article is from the New York Times, March 26, 1982.

“COMMODITIES; Linking Dow Average to Value Line Futures

By H. J. Maidenberg

Published: March 26, 1982

The new stock-index futures based on the Value Line average followed the overall price trend in the stock market yesterday by advancing 60 to 65 points, or $300 to $325 on a contract, with the active near-June delivery closing at 124.65, for a gain of 60 points on the day. (Bob’s note: a point is a penny and the leverage is $5 per penny).

Indeed, since the first stock-index futures began trading on the Kansas City Board of Trade last Feb. 24, contract prices have mirrored not only the Value Line average of 1,683 stocks, but also the ups and downs of the market.

”Our index futures are now being accepted as a true measure of market sentiment,” said Loren A. Brown Jr., a broker member of the exchange and head of the committee that fashioned the new investment instrument, ”now that many traders think they have discovered the price ratio between the Dow Jones industrial average and the Value Line.”

According to Mr. Brown, the generally accepted rule of thumb that is being used is a ratio of about 7 to 1; that is, each 100 points, or $1, move on the Value Line is equivalent to a $7 move on the Dow. Yesterday, the Dow Jones industrial average of 30 shares closed up $4.29, which is seven times greater than the 60-point gain on the active June Value Line futures.

How the Averages Differ:

One major difference between the two averages is that the Value Line average figures are calculated by a mathematical formula, while the Dow Jones average represents the dollar value of the 30 shares, adjusted for stock splits and related changes in prices.

Further, the futures price of the index is not necessarily the same as the Value Line average, compiled by Arnold Bernhard & Company. For example, an officer of the company noted that the average closed at 125.91, up 55 cents on the day, compared with the spot March futures, which ended at 125.65. The prices of the Value Line futures are determined in the trading pit of the Kansas City exchange.

But the Dow-Value Line ratio is deemed important because most traders have been accustomed to relying on the Dow Jones average as a convenient barometer of market sentiment, and some thought that investors would find it difficult to adjust their thinking to the much broader average. But the open interest, or the number of contracts that are open for trading, has grown steadily.

As of Wednesday’s close, the open interest had grown to 3,302 contracts. Yesterday’s figures will be released this morning, as is the practice on all commodity exchanges. Recent volume has averaged 1,900 contracts a session. This activity compares favorably with financial futures in their first month of trading.

Specifically, each index contract consists of the 1,683 stocks in the Value Line index multiplied by 500. Thus, the June futures contract, which closed yesterday at 124.65, works out to a value of $62,355 each, with each minimum move of five-hundredths of a point worth $25. Initial cash margins for speculators, or non-trade hedgers, has been set at $6,500, but most brokers require somewhat more good faith money.

Also, the stock-index futures are settled by cash on the last trading day of the delivery month. This means that buyers do not take physical delivery at expiration time, nor must those who have sold short come up with any shares.”

I traded the Kansas City contracts for a little more than one year. But the handwriting was on the wall for the CME and they introduced a futures contract based on the S&P 500 index. The CME had a broader appeal and their contracts surged in popularity displaying excellent liquidity.

The first SP500 contracts were equal to 10 mini contracts and the leverage was $500 per SP 500 point. I made the shift to the SP 500 contract as it became obvious that liquidity was much greater at the CME. With higher liquidity, market orders were executed with smaller deviations from the quoted price.

To this day I’m still trading the SP 500 futures contracts, but my use of leverage is low. I guess I’ve grown conservative in my old age and the gunslinger has also gotten smarter along the way. Just remember that with high leverage, you make a lot of money when correct and you lose a lot of money when you’re wrong.

Everyone should always use stops to control their losses while trading the SP 500 futures contracts. Some traders use mental stops, but the problem with mental stops is that the trader is likely to rationalize that the position is correct and it’s going to turn around very shortly. The situation usually only gets worse. I’ve never used mental stops, preferring the hard stop instead.

Stops should be placed carefully. You need to figure out what shouldn’t happen if your position is correct. At what specific point has your position gone wrong??? Place your stop at that point. This requires some thought to arrive at the right stop level. The stop should be entered immediately after your position is established.

I don’t believe in setting stops at a certain percentage above or below your position. That’s an arbitrary level and means you aren’t doing your homework. I believe that stops should be based on the penetration of a significant high or low that wouldn’t take place if your position is correct. Your position should be established reasonably close to your stop so your loss is easily tolerable if you’re wrong.

If you don’t use stops, you could freeze up and never liquidate your position until you have the forced margin call. Even worse is the unattended position. Somebody gets busy and forgets to watch their investment. When they remember to look they may be pleasantly surprised at how much money they’ve made, but what if they find they’ve lost a huge chunk of their account. It happens.

I urge those who are new to contract trading to limit their trading to one contract for a considerable length of time. It’s your learning experience at futures school and your learning isn’t complete until you’ve encountered all types of markets and market surprises, specifically a bear market.

My investing experiences began with growth investing. Evolved into position trading in the Dow Jones Industrials, the Value Line Index and then the SP 500 (individual stocks, Coral Index, Kansas City Value Line and now the CME SP 500).

Coming full circle, I’m seeking a growth investment again, but not for myself. It’s for my wife and it’s for a very practical reason.

——————————– SECTION THREE ——————————–

VALUE INVESTING

Recent book I’ve encountered are:

- “The Dao of Capital – Austrian Investing in a Distorted World” by Mark Spitznagel.

- “Margin of Safety: Risk-Averse Value Investing Strategies for the Thoughtful Investor” – by Seth Klarman

Wikipedia quote on Mark Spitznagel:

Spitznagel is known for his über-bearish “Austrian”-based stock market investing and pioneering “tail–hedging,” and most notoriously for his hugely profitable billion dollar derivatives bet on the stock market crash of 2008[2][3][4][5][6][7][8][9] as well as for having allegedly caused the stock market crash of 2010.[10] He is among The Wall Street Journal‘s “5 hedge-fund managers to watch of Wall Street’s biggest, boldest investors.”[11]

The Wikipedia thoughts on Spitznagel don’t seem to reflect value investing. It seems to reflect more of a speculator than investor.

Amazon – “The most helpful critical review” – “The Dao of Capital”

Money manager Mark Spitznagel has written a very wordy paean to Austrian Economics. If ever a book needed a tight fisted editor this one is it. However, once you get beyond reading every thing Spitznagel knows about Austrian Economics the reader will get a better understanding of economics and the investment process. The key takeaways from the book are the core notions of Austrian Economics which value roundabout(indirect) production over direct production and the role of monetary policy to distort investment decisions. For example, in the case of the former, the direct route to catching a fish would be to try to grab one in a pond while the roundabout and far more profitable route would be to make a net first and then use it to catch fish.In case of the latter, the low interest policy of the Federal Reserve induces investment that will be proved unprofitable once interest rates normalize leading to a bust. This knowledge leads investors to hedge tail risks when stock market trade at high price/replacement cost ratios and to buy individual stocks that with high returns on capital that won’t be affected by increases in interest rates. Nothing really new here, but puts some real foundation underneath it. That is the value of the book.

Wikipedia quote on Seth Klarman:

An American billionaire who founded the Baupost Group, a Boston-based private investment partnership, and the author of a book on value investing titled Margin of Safety: Risk-Averse Value Investing Strategies for the Thoughtful Investor.

Amazon – “The most helpful favorable review” – “Margin of Safety”

- VERY LONG COMPLETE REVIEW

This book is one of the hardest finance books to track down today. Published in 1991, it is now out of print, and sells on Amazon and Ebay for over $1000. It is even one of the most-stolen library books, making it very difficult to find a copy to read.

Seth Klarman, the portfolio manager of The Baupost Group, is a very successful practitioner of the value investing strategy. In this book, he sets out to educate the reader on this concept, stressing the advantages of a risk-averse approach. In his introduction, Klarman states that even if this book, as a side effect of educating more people to invest in a more sophisticated manner, causes diminished returns to himself – he considers it well worth it for the public good. While I highly applaud this mentality, it begs the question: why was the book not published again? Considering what I mentioned in the first paragraph, clearly there is significant demand to read it. Anyway, on to the book itself…

“Margin of Safety” is divided into three portions. The first part discusses where most investors make mistakes and stumble – it covers investing vs. speculation, the nature of Wall Street, and how institutional investing results in a short-term performance derby (of which the client is ultimately the loser). It also encapsulates the presented information in a thoughtful case study of junk bonds in the 1980s. The second portion of the book introduces the details of the value-investment philosophy, primarily focusing on risk and how it is crucial to invest with a margin of safety. The last part provides useful applicable advice on actually following the value-investment process: where to find investment opportunities, how to invest in these opportunities, and various aspects of overall portfolio management.

Simply put, the book is fantastic. Klarman writes in an amazingly clear manner. His language is neither too simplistic nor overly difficult – just right. I definitely experienced a “wow” feeling when I began reading, after the finance books I have read recently. In addition, Klarman provides a myriad of examples to illustrate the points he brings up, which is very helpful, because it puts a reality spin on his writings.

Don’t, however, mistake “clear writing” for “easy content.” While the book is clear, precise, and very straight-to-the-point (i.e. there is no useless fluff frequently found in books advocating certain investment approaches), Klarman’s content is not trivial. The first and even the second portions of the book are relatively quick and simple – after all, the material presented (a discussion of various common investor mistakes, followed by the basic explanation of value investing) is not overly difficult. The third and last portion of the book, however, is very dense: a lot of information is presented quickly. I actually found myself having to re-read a few of the later chapters multiple times, making sure I understand what Klarman was trying to illustrate. I took notes while reading, so that helped absorb the material – but it still wasn’t easy.

This brings me to the only personal gripe I had with the book. There were multiple instances in the later chapters where I wished that Klarman would elaborate more on some of his statements and examples (for instance, calculating NPV for certain businesses, more discussion on thrift institutions, etc.). The author certainly assumes some previous experience, as some of his non-basic explanations are clearly not geared for outright beginners. There was never a point, however, where I felt completely out of the loop. I had to read some portions over again and even look up additional information on the web, but in the end Klarman’s words always made sense.

This book is absolutely the best overview of value investing I have ever read or heard. Klarman stresses the importance of carefully evaluating risk (as we often only focus on return) and investing with a margin of safety. He repeats this main point over and over again throughout the entire book. Amazingly, it doesn’t feel overly repetitive – but instead, a constant timely reminder of the ideas behind the value investing process. A major theme in the book is that we can’t predict the future, and hence we must always be ready for anything – and the only way to do this is to protect our investments with a sufficient margin of safety (essentially investing in a security at a significant discount to underlying value).

Aside from a clear explanation of his investing philosophy, Klarman provides tons and tons of useful practical advice, from how to valuate businesses (he makes sure to distinguish his preferred methods from other widespread strategies) to where to find excellent investment opportunities for value investors. He devotes multiple chapters to discussing the frequently neglected portions of the market where low-risk and potentially high-return investments can be made. In the last two chapters, Klarman takes a step back from discussing individual investments and focuses on overall portfolio management and various alternatives for the individual investor.

One may wonder how applicable some of the specific advice is today. Are thrift conversions really still good places to find hidden value? Maybe not. Is manually calculating the cash flow of a business through the faulty measure of EBITDA still a problem today? Not really, since cash flow statements are now part of the required financial statements for public companies. But a lot of Klarman’s essential advice (do your analysis carefully – look behind the numbers) and much of his presented “fertile ground for opportunities” still applies and exists today. Furthermore, the wonderful thing about value investing is that it is contrarian in its nature – which essentially implies that, as investments in various portions of the market come in cycles, a value investor can patiently wait for a popular area to “overflow”, collapse, and offer excellent opportunities to invest while the herds of investors shy away and sell out. So even if some of Klarman’s hunting grounds may seem outdated right now, they will again be attractive in the future.

One thing to note is that each chapter contains a set of footnotes. I advise the reader not to ignore these – they sometimes contain interesting examples and valuable advice. Unfortunately, they are easy to skip, as they’re not printed at the bottom of the page which references the footnote, but rather at the back of each chapter.

In conclusion, I highly recommend Klarman’s book to… anyone, really! Seasoned veterans will undoubtedly find excellent insight into things that may have before seemed ordinary and trivial. Beginners will learn fantastic advice that may help steer them away from poor decisions made by many inexperienced investors today. I personally don’t think it is worth paying the market price for the book today just to read it (although many may argue that even the going price is at a huge discount from the underlying value) – but I suggest trying to obtain the book through an Inter-Library Loan. It may take some time and effort to find a copy, but it’s well worth it.

Pros:

+ clear and concise writing, no fluff

+ lots and lots of illustrative examples

+ very clear explanation of the basic concept of value investing and a margin of safety

+ useful methods for researching and valuating a business

+ tremendous amount of applicable advice on finding and analyzing investment opportunities

+ lots of other real-world advice on various topics from portfolio management to money manager selectionCons:

– last portion of the book is dense, may require careful reading and re-reading

– a small portion of the material may be slightly out of date (don’t let this deter you)

- That’s sticker shock.

- Some of these “new” books may be reprints and expensive rip-offs of the original collector’s (???) edition. Buyer Beware!

- Or don’t buy at all. Steal a copy from a friend (soon to be ex-friend).

- Visit your public or campus library to find a copy of this book. Incidentally, this is one of the most “lost” books in libraries.

- I’ve heard that a PDF copy of this book exists, but I don’t know who has it for sale.

- I’m reading a friend’s copy (possibly a future ex-friend).

——————————– SECTION FOUR ——————————–

Seth Klarman videos

- Charlie Rose interviews Seth Klarman (14 minutes)

- Seth Klarman guest lecture at Harvard’s Psychology of Leadership course (48 minutes)

- Seth Klarman comments on writing his book (90 seconds)

Value Investing – Videos

- The World’s Best Investment Advice From Value Investors -Part 1 (41 minutes)

- The World’s Best Investment Advice From Value Investors -Part 2 (42 minutes)

- The World’s Best Investment Advice From Value Investors -Part 3 (37 minutes)

- The World’s Best Investment Advice From Value Investors -Part 4 (30 minutes)

- The World’s Best Investment Advice From Value Investors -Part 5 (35 minutes)

.

- The stock market VALUE bible since its first publication in 1949.

——————————– SECTION FIVE ——————————–

So what’s all this value investing have to do with me???

I’ve been looking for an investment idea intended for my wife. In the event that something happens to me (kicked the bucket, wearing Depends 24 hours, drooling old fool, etc), I wanted a single idea investment hedge against inflation for her future.

I had an account in place several years ago for this purpose and everything worked perfectly. Investment returns were greater than the SP 500 with no losses. It was the perfect investment for my wife. I just hadn’t obliged her by kicking the bucket.

Everything was going along great . . . until something unanticipated happened.

The one man investment advisory company died (literally). The best laid plans can certainly go awry and it shows why you should never rely on a single person investment.

I’ve been causally looking (too lazy to look hard) for a replacement investment since the adviser’s death. A couple of weeks ago I discovered the Sequoia Fund and it appears to meet my parameters.

Incidentally, Sequoia fund has been recommended by Warren Buffett. Sequoia is a Warren Buffett “look-alike” fund because their objectives are exactly the same, but their holding are different. Sequoia (SEQUX) has had greater gains in recent years than Berkshire Hathaway (BRK-A). Sequoia does have a sizable investment in Buffett’s company, Berkshire Hathaway, but has been reducing their holdings in BRK-A in the last few years.

Looking at the above list, I wasn’t really interested in the 1, 3, and 5 year ratings. Funds can catch the occasional lucky streak that distorts their short term returns. I was interested in seeing how a fund performed as they were grinding it out over a 20 year period. 20 years gives you an idea if management can consistently perform.

SEQUOIA FUND

In my quick look at the funds in the 20 year category (from the above list), I was quickly struck by Sequoia Fund because it had some interesting characteristics.

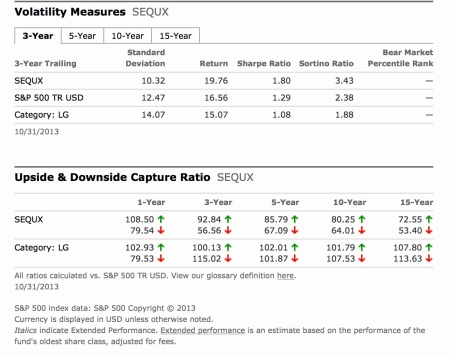

On the Morningstar page:

- The risk rating was a dark green single bar. That’s low risk.

- The Return vs. Category was 4 lighter green bars. That’s well above average return.

- Combining the two, you’re looking at an investment with lower risk and above average return. That appears to be a sweet combination.

Here are some of the Morningstar stats on Sequoia Fund (SEQUX)

Click to enlarge

Now I’m not saying that Sequoia Fund is the best long term fund in the world. It’s simply the best that I have discovered that met my purposes, which is consistent growth (staying well ahead of inflation) and very low volatility during a bear market. Low downside volatility during a bear market is a very big factor as my wife probably wouldn’t know how to avoid a bear market. I’ve already stated previously my aversion to bear markets.

If you know of a better fund, keeping in mind the metrics that I’ve used, please let me know via the comments at the bottom of this page. Any help is deeply appreciated.

Here’s some old news about Sequoia Fund illustrating that Sequoia has a history of closing when they have too much capital. They have 20% of their capital in cash at the moment. You never know when they’ll close their doors again. Maybe tomorrow, 10 years, or never.

Sequoia fund to re-open after 25 yrs

Sequoia Fund (NASDAQ: SEQUX), run by investment advisor Ruane, Cunniff & Goldfarb, will reopen its doors to new investors on May 1, 2008. This grand old fund has been closed since Dec. 23, 1982. The New York-based fund shop says that its shareholders have aged since that time and consequently, attrition has become an issue.

Look at the following chart from the Sequoia website.

It shows that if you had invested $10,000 in Sequoia on July 15, 1970, you would have $3,567,000 today. Investing in the SP 500 during the same period, your investment would have grown to $815,000 (short by $2.7 million in comparison).

The following is the percentage return table by year for Sequoia. Always watch the negative years, the positive years usually take care of themselves. If you can keep your losses under control, you’re doing something right.

SEQUOIA INVESTMENT RETURN TABLE

![]()

|

Comparison of the Investment Return of the Sequoia Fund |

||

|

Average annual total return: |

14.57%

|

10.72%

|

|

Change for the entire period: |

35574.05% |

8058.10% |

|

Period Ending |

Sequoia Fund

|

S&P 500

|

|

9/30/2013

|

23.36%

|

19.79%

|

|

12/31/2012

|

15.68%

|

16.00%

|

|

12/31/2011

|

13.19%

|

2.11%

|

|

12/31/2010

|

19.50%

|

15.06%

|

|

12/31/2009

|

15.38%

|

26.46%

|

|

12/31/2008

|

-27.03%

|

-37.00%

|

|

12/31/2007

|

8.40%

|

5.49%

|

|

12/31/2006

|

8.34%

|

15.80%

|

|

12/31/2005

|

7.78%

|

4.91%

|

|

12/31/2004

|

4.66%

|

10.88%

|

|

12/31/2003

|

17.12%

|

28.69%

|

|

12/31/2002

|

-2.64%

|

-22.10%

|

|

12/31/2001

|

10.52%

|

-11.89%

|

|

12/31/2000

|

20.06%

|

-9.10%

|

|

12/31/1999

|

-16.54%

|

21.04%

|

|

12/31/1998

|

35.25%

|

28.57%

|

|

12/31/1997

|

43.20%

|

33.34%

|

|

12/31/1996

|

21.74%

|

22.99%

|

|

12/31/1995

|

41.38%

|

37.53%

|

|

12/31/1994

|

3.34%

|

1.30%

|

|

12/31/1993

|

10.78%

|

10.06%

|

|

12/31/1992

|

9.36%

|

7.62%

|

|

12/31/1991

|

40.00%

|

30.45%

|

|

12/31/1990

|

-3.80%

|

-3.14%

|

|

12/31/1989

|

27.91%

|

31.65%

|

|

12/31/1988

|

11.05%

|

16.57%

|

|

12/31/1987

|

7.40%

|

5.22%

|

|

12/31/1986

|

13.38%

|

18.70%

|

|

12/31/1985

|

27.95%

|

31.76%

|

|

12/31/1984

|

18.50%

|

6.26%

|

|

12/31/1983

|

27.31%

|

22.56%

|

|

12/31/1982

|

31.12%

|

21.59%

|

|

12/31/1981

|

21.49%

|

-4.93%

|

|

12/31/1980

|

12.66%

|

32.51%

|

|

12/31/1979

|

12.05%

|

18.63%

|

|

12/31/1978

|

23.93%

|

6.51%

|

|

12/31/1977

|

19.88%

|

-7.20%

|

|

12/31/1976

|

72.37%

|

23.96%

|

|

12/31/1975

|

61.84%

|

37.30%

|

|

12/31/1974

|

-15.48%

|

-26.52%

|

|

12/31/1973

|

-24.80%

|

-14.72%

|

|

12/31/1972

|

3.61%

|

18.98%

|

|

12/31/1971

|

13.64%

|

14.29%

|

|

12/31/70*

|

12.11%

|

20.60%

|

|

Includes dividends, and in the case of the Sequoia Fund, capital gains distributions as if reinvested. |

||

In 2008, when mutual funds were losing 40 to 50%, Sequoia lost -27% and the SP 500 lost 37%. One of the cardinal rules is to limit your losses during bad times. Sequoia made up their 2008 loss in the next 18 months and has surged far ahead of their pre-2007 price levels.

In the return table, notice the years 2008, 2002, 1999, 1990, 1974, and 1973. They all have negative returns. There were only 6 years with a loss out of 43 years. That’s not too shabby.

The greatest loss was 27% and it was 2008. In 2008 the US financial system was very close to collapse and a depression was a whisper away.

The smallest loss for Sequoia was -2.64% in 2002 (that was a another bad year and the SP 500 was down -22%).

The period from 1999 to 2008 had two devastating bear markets. Let’s take a look at what Sequoia and the SP500 did during those years.

|

During those years Sequoia had a simple cumulative total +30.7% and the SP 500 had a simple total of +6.7%. If we plug these numbers into an Excel spread sheet and look at the compounded difference, we find a greater difference in return.

In the spreadsheet I began with an invested total of $100 at the beginning of 1999.

- Sequoia had a compounded total of +22.1%

- SP 500 had a compounded total of -13.0%

Excel Sheet

Since inception Sequoia has grown an average of 14.57% each year compared with the SP 500 annual return of 10.72%. Compounding these figures over the years is what makes the return comparison really big.

Sequoia has been closed to investors in the past, but it’s open now. You must buy direct from the fund, no brokerages allowed or secondary market trading.

It’s not unusual for successful funds to close when they have too much money to manage. Sequoia has a lot of money right now (8 billion). At some point in the future it wouldn’t be surprising if they closed again, but I have no idea when. Once you have an initial investment account with Sequoia, you have your foot in the door for future investments with them, closed or otherwise.

Sequoia has about 8 billion dollars under management. After they closed the first time, their assets were about 6 billion. When they closed, their money under management dwindled to about 3 billion through attrition (people die – heirs withdraw money, investors take money out for retirement, etc). Presently they have almost tripled their low point assets.

Minimum investment account in Sequoia is $5,000 and the minimum IRA investment is $2,500.

As with all successful mutual funds, you want to re-invest dividends and capital gains back into the fund. This makes a significant difference towards compounding your money.

Sequoia is a no load fund and you buy shares directly from the fund.

I think one should pick and choose their investment timing carefully when buying a value fund such as Sequoia. Is the present the best time to invest heavily in a fund like Sequoia??? Opening the door with a minimum investment is not a bad idea though.

Always read the prospectus for any mutual fund.

Google Sequoia fund to see what others are saying about them, good and bad.

Don’t invest in Sequoia because I bought it.

Do your own research on any investment and:

“Spend at least as much time researching a stock as you would choosing a refrigerator.” – Peter Lynch

——————————– SECTION SIX ——————————–

JEFF SAUT – 11/25/13

“I can calculate the movement of the stars, but not the madness of men.”

… Sir Isaac Newton, after losing a fortune in the South Sea bubble

In 1711 the Earl of Oxford formed the South Sea Company, which was approved as a joint-stock company via an act by the British government. The company was designed to improve the British government’s finances. The earl granted the merchants associated with the company the sole rights to trade in the South Seas (the east coast of Latin America). From the start the new company was expected to achieve huge profits given the believed inexhaustible gold and silver mines of the region. It was anticipated the company would ship British goods to the South Seas where they would be paid for in gold and silver. Rumors swirled that Spain was going to give free access to its ports in Chile and Peru for a share of the South Seas stock and share prices soared. Sir Isaac Newton was an early investor in the stock, investing a decent amount of money into the shares. He exited those shares a number of months later with a good profit, leaving him a happy investor. Subsequently, the shares soared into bubble proportions, and as Newton saw his friends getting rich, greed overtook fear and Newton took most of his cash and re-bought the shares. Not long after that, the share price peaked, and then crashed, leaving Sir Isaac Newton broke (see chart).

I revisit the South Seas bubble, which is chronicled in Charles MacKay’s epic book, Extraordinary Popular Delusions and the Madness of Crowds,”

Memoirs of Extraordinary Popular Delusions and the Madness of Crowds

(The book is free from Google Books because it was written in 1852 and the copyright has expired)

“not because I think the equity markets are in a bubble (I don’t), but as an example that even one of the most brilliant men in history was overcome by greed at exactly the wrong time. As my father used to say, “In the long-term it is all about earnings, but in the short/intermediate-term the stock market is fear, hope and greed only loosely connected to the business cycle.” He also taught me that cash is an asset class, unlike many in our business who don’t believe it. As the brilliant investor Seth Klarman espouses (as paraphrased by me), “To assume the investment opportunity sets that are available to you today are as good (or better) than those that will present themselves next week, next month, next quarter is naive and you need to have cash to take advantage of those new investment opportunity sets.” For those of you that don’t know who Seth Klarman is, he is an American billionaire who founded Baupost Group, a Boston-based private investment partnership. He is also one of the best money managers on the planet and has the track record to prove it. He authored a legendary book that sits on my desk titled Margin of Safety: Risk-Averse Value Investing Strategies for the Thoughtful Investor. Recently Seth spoke at James Grant’s investment conference. Here are some of his comments, as paraphrased by me. To wit:

Of the $30 billion we have under management, $14 billion resides in cash because we don’t see a lot of compelling investment opportunities currently. The ones we find, we pull the trigger on and purchase. We worry about things from a “top down” standpoint, but pick our investments on a “bottoms up” (fundamental) basis. We think inflation is likely and view gold at these levels as the best hedge against a worst case environment. However, we only have a couple of percent of assets positioned in gold. We own some commercial real estate in Japan and a few equities, as well as some investments in Russia.

In viewing Seth’s purchases I found it interesting that Baupost recently took a significant position in one of Raymond James’ Strong Buy rated stocks, namely Micron (MU/$20.19/Strong Buy). Along this individual stock investment line, in last week’s Morning Tack I mentioned if we get some kind of pullback in the weeks ahead, investors should consider purchasing stocks with strong “power ratings.” I have received numerous emails for such a list. So this morning I give you a number of those stocks, which not only have strong “power ratings” and Outperform ratings from our fundamental analysts, but also screen positively on my proprietary trading system. The list includes: Amerisource Bergen (ABC/$70.02), CVS (CVS/$66.68), Delta (DAL/$28.60), Federal Express (FDX/$137.07), McKesson (MCK/$163.61), Lincoln National (LNC/$50.48), Bard (BCR/$139.85), and Old Republic (ORI/$17.36). Like stated last Monday, put these stocks on your “watch list” for potential purchase.

This week, we enter the holiday-shortened week of Thanksgiving and I will be in New Orleans and then the Washington D.C./Richmond, Virginia areas. The history of the week is generally positive having averaged a gain of 0.65% since the mid-1940s about 62% of the time. It will therefore be interesting to see if the historic precedent takes control, or if my timing models prove correct and a moderate pullback commences. One thing for sure is that Wall Street attendance will be limited as the “pros” desert the Street of Dreams for the holiday. Also of interest will be how the equity markets react to the first substantive Iranian nuclear deal in a long time. Indeed, for the second time in three months, our President has pulled a rabbit out of his hat. First it was the Syrian solution, thank you, Vladimir Putin. Last weekend it was the deal struck between Iran and six of the world’s nations. The deal places qualitative/quantitative restrictions on Iranian nuclear enrichment for the next six months. Following that, a longer-term agreement is to be negotiated. Strategically, one would think said deal might take some of the geopolitical risk premium out of world oil prices. Tactically, however, the world’s Iranian oil embargo remains in place. According to the White House, “In the next six months, Iran’s crude oil sales cannot increase.” Consequently, Iran’s oil exports will remain capped (cut by ~1.5 MMbpd since 2012), which is neutral for near-term oil market fundamentals, according to our fundamental analysts. Yet this morning, crude prices are noticeably lower.

The call for this week: The divergences of the past few weeks continued last week. For example, the number of new 52-week highs on the NYSE has diminished over the past three weeks. Additionally, the Advance/Decline Lines for most of the small-cap complexes have not made new highs. NYSE stocks above their respective 50-day moving averages continue to decline, many of my overbought/oversold indicators are currently overbought, the S&P 500 is at the top end of its Bollinger Band (read: caution), bullish sentiment is at a decade high (read: caution), interest rates are rising, housing is stalling because mortgage rates have risen and affordability is diminishing, real final sales are sluggish, the global economy is under pressure, yet the Federal Reserve still has the peddle on the metal. And that, ladies and gentlemen, has been able to trump any of the natural forces suggesting a pullback. While I recommended recommitting some of the cash raised last June when the Syrian Solution arrested the anticipated decline at 6% versus my expectation of a 10% decline in August/September, I still have too much cash at a 25% recommendation given what the markets have done. Hopefully, we can still get some kind of pullback into early December setting up the fabled “Santa Rally.” As stated, the first support zone exists between the upper pivot point of 1784 and the previous reaction highs of 1775. Falling below that brings into view the 1750 – 1760 level, which if violated would suggest a 5% – 7% correction. This morning, however, world markets are celebrating the Iran deal with the pre-opening futures better by about 5 points. Yet, as the world likes the deal, two of our staunchest allies, the Israelis and Saudis, are fuming. Hereto, it will be interesting to see what happens to oil prices if the Saudis decide to make their displeasure felt.

JEFF SAUT – 12/2/13

Well, so far the Federal Reserve is winning out over my timing models that continue to suggest caution should be the preferred strategy in the short-term; and last week that strategy was wrong footed as the D-J Industrial Average (INDU/16086.41) notched another new all-time high. Still, over the years I have learned to trust my indicators even if at times they have proven overly cautious. Indeed, better to lose face and save skin! Nevertheless, in my travels last week I continued to talk to various portfolio managers (PMs), and this week I am in New York City seeing more PMs and visiting with the media. Late last week I reconnected with David Ellison, portfolio manager of the Hennessey financial funds. In a recent missive David had this to say:

Conclusions from recent company visits:

- Credit conditions are continuing to improve.

- Loans going on the books the last 3-5 years are the best quality in 25-30 years.

- Loan demand is slowly picking up – starting to see competition.

- Cost cutting/efficiencies are a growing management focus. – 2-3 years to work through.

- Improving fee income another growing focus of management – loan demand will help this effort.

- Balance sheets are liquid with much improved liability structures – I see some of the best balance sheets of my 30-year career.

- M&A activity expected to increase as regulatory process clears up – everyone is looking.

- Dividends and buybacks are expected to increase.

- Valuations (P/E and PR/BK) are around the average historical ranges.

In general, companies will benefit from higher lending activity as liquidity (yielding 0.25% at the Fed) is deployed into loans at current rates in the 4% range. Companies will benefit as cost cutting and fee income enhancements work through the income statement. Companies will benefit as credit continues to improve and the cost associated with bad assets abates. I believe a rise in rates and/or increase in loan demand will benefit EPS growth more than the market believes. I believe the market is underestimating the benefit of cost cutting and fee enhancement. I believe M&A activity will be more than expected as recent deals have been accretive and stocks of both buyer and seller have risen. If you believe the economy is getting better, and this will show up in loan demand and modestly higher rates, then I think financials are an attractive investment. Financials are “economic growth stocks.”

And then there was this from another portfolio manager friend, namely Shad Rowe, founder of Dallas-based Greenbrier Partners, who had this to say in his recent letter to investors:

The questions I am most often asked, and the questions I ask myself are: “Is the bull market over?” “Is it too late to own stocks?” “Is it time to get defensive?” My answer to each question is a cautious “No.” A useful stock market adage is, “A bull market climbs a wall of worry.” Goodness knows our elected officials in Washington have given us plenty to worry about. As a result, distracted investors may be ignoring developments both in Washington, and in our economy, that may enable a more sustained bull market than most people can contemplate. We have been over these developments in previous letters so we will skip covering old ground. Meanwhile, our major themes appear to be intact and our companies’ businesses are performing as hoped. Our top 16 positions represent approximately 89% of our equity and are listed below in descending order of value. Included are our rationales for continuing to own these stocks.

Of those 16 stocks, six of them are followed by our fundamental analysts with favorable ratings. They are listed below with Shad’s reason for owning them:

Facebook (FB/$47.01/Outperform). Facebook is the backbone of the social media experience for more than one billion connected users around the world and provides the means for marketers to reach these potential customers with more efficiency and precision than has ever been possible.

Apple (AAPL/$556.07/Strong Buy). Apple represents the most desired digital ecosystem in the world and it trades at a discount in comparison to its peers, the market, and its intrinsic value on virtually every metric.

Google (GOOG/$1059.59/Outperform). Through organizing and providing access to the world’s information, GOOG has become the most powerful force in advertising and is navigating the transition to mobile and video beautifully.

eBay (EBAY/$50.52/Outperform). eBay has quietly put together a powerful combination of digital assets that position the company to thrive in the $10 trillion global commerce and payments markets.

Bank of America (BAC/$15.82/Outperform). Bank of America represents a proxy on an improving domestic economy and a company that still has vast room for operational improvement.

Qualcomm (QCOM/$73.58/Outperform). Qualcomm’s patented technology and innovative products are vital to the growing, global mobile device industry and management has a proven track record.

As for last week’s stock market action, despite signs of increased risk of another pullback the equity markets notched new highs with the NASDAQ Composite actually closing above 4000 for the first time since 9/7/00. The D-J Industrials have now made it eight weeks in a row on the upside, although Friday’s late sell-off was somewhat disappointing. The upside skein has left five of the 10 macro sectors pretty overbought with the remaining five being Consumer Staples, Energy, Materials, Telecom Services, and Utilities, which are not overbought. Interestingly, eight of the 10 S&P macro sectors closed lower for the week, a sign there is at least some kind of distribution going under the guise of higher major market indices. Moreover, the S&P 500 (SPX/1805.81) is trading at its highest price-to-earnings ratio in a year. In addition to my timing models continuing to counsel for caution, there are signs that the stock market is becoming more selective. For example, the percentage of stocks above their respective 30-day moving averages continue to trace out lower highs and lower lows, as can be seen in the chart on page 3 from the good folks at the Lowry’s organization. Further, one of my indicators is flashing a warning sign not seen since the tops in 2007 and 2000. Yet I have to admit, time is running out for the bears because I have learned the hard way it is tough to put stocks away to the downside in the ebullient month of December.

The call for this week: While time may be running out for the bears (this week should tell), time is not running out to start making your tax-loss bounce list. Remember, some stocks that have not performed this year will be sold for tax losses to offset gains taken in other positions during 2013. To that point, there was a story in the weekend Wall Street Journal titled “Coal Plants Shut By Marcellus Glut.” The gist of the story is that coal-fired utility plants are shutting down because natural gas is so cheap in certain areas of the country, and electric prices are so weak, that nobody can make a profit. The story reminded me of when “they” were closing copper mines like the Anaconda Copper Mine in Lyon, Nevada back in 1978, and all the copper stocks were screaming buys. Over the next few weeks I will be looking at the beaten up coal stocks, as well as other tax-loss bounce candidates.

Jeffrey Saut of Raymond James is a very savvy guy and one of the very few interesting people that I follow. After reading his column over the years, it is obvious that he is smart, insightful and normally right on the mark.

Regarding Jeff’s recommended stocks, some have done well in the past, but quite a few have been duds or outright losers. I think of Jeff as a stock market strategist, a very good strategist, but not a person to follow in recommending specific stocks.

Jeff reminds me of Robert Farrell of Merrill Lynch fame (1970s and 1980s), who achieved a large following and was frequently on target. Bob Farrell was one of my favorites and so is Jeff.

——————————– SECTION SEVEN ——————————–

JIM ROGERS

11/26/13

Eventually [the Fed] will try to cut [Quantitative Easing]; it will finally cause the collapse. At that point, we will have a big change, because they will throw them out, whether it’s the politicians or the central bankers or whoever … and then we’ll finally start over. But it may be really painful in the meantime.

11/24/13

If and when the Federal Reserve stops or even slows down printing money, and other banks also slow down, I do not think the Japanese will slow down. Maybe the English and the European banks will. There will be a moderating affect on markets because that is where most of the money has gone.I am not sure it (Fed slowing down money printing) is going to happen. Firstly, Bernanke will not do it while he is here (Fed Chairman) because he does not want to go out with an egg on his face. Secondly, Ms Yellen is coming in. I doubt if she is going to do it at first anyway because, a) she is keen on printing money and b) she knows what will happen when they start slowing down. So she is not going to do it anytime soon. If they do start slowing down, the markets are going to react and they (Fed) will panic and come back and say, “oh we are sorry”. So, I do not see much tapering anytime soon.The market eventually will force them (Fed) to cut back. Eventually, the market is going to say, “we do not want this garbage paper anymore, we do not want to play this game anymore”. But, I do not see that happening anytime soon

11/20/13

I have learned, for whatever reason, to know that change is coming, to know to think against the crowd, that the crowd is nearly always wrong and to try to think for myself. Now, I certainly make plenty of mistakes and have made plenty of mistakes in my life, but these are some of the things that I have learned, to try to think around the corner, try to think to the future if you want to be successful.

11/16/13

No, I don’t think the next round of crisis is coming soon; individual countries may have some problems. I don’t see a global crisis coming soon because everyone is printing money. In America, there is no constraint on printing money and there is no constraint on government spending because of recent actions. Japan is not going to slow down printing money. There are no constraints on this madness that is going on. But, this is madness and will end in disaster. The disaster may not come till 2017

Some of Jimmy’s predictions can take years to to mature. I usually bury his ideas in the back of my mind and wait for signs of movement in his prediction. If his prediction is broad based, there is usually lots of time to take advantage.

It’s interesting that Jimmy mentioned 2017 as the disaster date as I’ve been fascinated with 2018 for quite some time (since 2000). I’m unsure of Jimmy’s statement whether he’s saying the onset is 2017, or the collapse will finish in 2017. I guess we’ll have to wait and see, or perhaps he’ll make a clarification in the future.

If we had a 4th and 5th wave extension counting from March 2009, it’s possible the bull market could last until 2018. That would be a significant difference from my original prediction for 2018. I had said that 2018 was the primary date for the bottom of the 3rd step down since 2000.

Jim Rogers Beginnings

Jim Rogers started trading the stock market with $600 in 1968. In 1973 he formed the Quantum Fund with the legendary investor George Soros. Jim retired a multi millionaire at the age of 37. Rogers and Soros helped steer the fund to a miraculous 4,200% return over a 10 year span of the fund while the S&P 500 returned just 47%.

——————————– SECTION EIGHT ——————————–

A couple of axioms that “might” come into play this year.

“If Santa fails to call the bears will roam on Broad and Wall!” – Lucien Hooper

“When the Dow closes below its December closing low in the first quarter, it is frequently an excellent warning sign. – Lucien Hooper

The following is from Stock Trader’s Almanac.

Lucien Hooper was a Forbes columnist and Wall Street analyst back in the 1970s. Hooper dismissed the importance of January and January’s first week as reliable indicators. He noted that the trend could be random or even manipulated during a holiday-shortened week. Instead, said Hooper, “Pay much more attention to the December low. If that low is violated during the first quarter of the New Year, watch out!”

Hooper’s “Watch Out” warning was absolutely correct. All but one of the instances since 1952 experienced further declines, as the Dow fell an additional 11.1% on average when December’s low was breached in Q1. Only three significant drops occurred when December’s low was not breached in Q1 (1974, 1981, and 1987).

——————————– SECTION NINE ——————————–

Edson Gould estimated the length of a bear market at 1/3 of the preceding bull market. Gould’s 1/3 fraction (.333) could be a rough approximation of the Fibonacci fraction, .382

For example:

The last “true” bear market ended in 1974. The ensuing bull market from 1974 to 2000 was 26 years. The following bear market should last about 8-10 years. The March 2009 bottom fell into the middle of this time zone.

Will we have a 3rd step down that will show a relationship to step 1 and step 2 down as shown in chart #10.0 in My Charts.??? “To be, or not to be, is the question.”

If a 3 step grand bull market cycle ended in 2000, it follows that we should correct for the entire cycle and not just the most recent bull market. The result should be a bear market of longer length and ferocity than normal. This is the basis of my 3 large step bear market theory that began in 2000.

A grand bull cycle is composed of 3 separate and lengthy bull markets.

Considering the above statement, we could not have completed a grand cycle if we date the beginning of the bull cycle from 1942 (which I have done repeatedly). From 1942 I can only count 2 bull markets. The second bull market is still in progress (1974 to the present).

An alternate assumption is that 2000 was the end of the generational bull market and the grand cycle bull market began in 1932. This does meet the requirements of 3 separate bull markets.

Stock prices went from a peak in 386 in 1929 to a low of 36 in 1932. In 1929, everyone wanted to own stocks. At the bottom in 1932 no one wanted to own stocks. This meets the pendulum swing I will refer to a few more paragraphs.

Beginning at the low in 1932 (no one wanted to own stocks), we have step 1 up ending in 1937, step 2 ended in 1973 and step 3 ended in 2000 (everyone wanted to own stocks).

Since 2000, we have had a wave extension with step 4 ending in 2007 and step 5 still underway.

Calculating from the new suppositions:

The end of the bull market was 2000, subtract the beginning of the bull market, 1932 and you get 68 years. 1/3 of 68 years = almost 23 years, adding that to the 2000 peak, we have 2023. Using the Fibonacci fraction of .382 times 68 years, we have 26 years and we have 2000 + 26 = 2026.

This alternative scenario says that the end of step 3 down would end in the period 2023 to 2026.

Go back to the chart above that shows the Dow since 1900 and it’s easy to see the 5 steps up, Steps 3, 4 and 5 are closely spaced together which seems logical, because the true end to the bull market cycle was step 3 in 2000. Everything since then is government interference as they manipulate the economy to avoid a depression. It’s probable that government interference should eventually fail and things will take their natural course.

Bob Farrell said that the market moves from extremes as the pendulum moves from one extreme to another.

2000 was a huge extreme in human behavior, even greater than the behavioral peak in 1929. In 2000 everyone wanted to own stocks. Following Bob Farrell’s theory to its conclusion, the next extreme in human behavior should be a period where owning stocks would not be popular for a long period of time. Witness the length of time it took the Dow Industrials to exceed the 1929 peak. We didn’t see a return to the peak closing of September 3, 1929 until November 23, 1954. This is how the pendulum moves, it takes a long time for stocks to come back into favor after seeing a generation extreme in human behavior.

After the 2000 blowout extreme in human behavior, stocks exceeded their 2000 peak in 6 years. The 2007 peak was exceeded again in only 4 years. That’s a really fast pendulum. The 1929 pendulum swing took 25 years to see a new peak. Generational peaks mean exactly that . . . . generational. A generation or more must pass before we see another repeat.

The peaks of 2007 and 2013 have not been accompanied by crazy public speculation that was prevalent at the 2000 peak. This supports my contention that 2000 was a generational peak in human behavior.

The public investor who is knowledgeable has been moving back into this market since 2009. The ill-informed public has only recently begun to dabble in this bull market as the news reaches them that the market is making new all-time highs. With the ill-informed public investor beginning to dabble in the stock market it’s classic that we are closer to the end of this bull market than the beginning. As Humphrey Neil once said:

The public is right during the trends but wrong at both ends.

People (aka the public) are predictable and Jessie Livermore said:

Wall Street never changes, the pockets change, the suckers change, the stocks change, but Wall Street never changes, because human nature never changes.

In the chart below there is a theoretical long cycle low predicted around 2026. It’s on far right lower section of the chart where several semi-circles are shown bottoming. The longest cycle shown bottoming is the 18 year cycles with numerous other shorter cycles bottoming in the same general area. They are all related to the 2009 low, which is considered to be a major cyclic low.

The cyclic low predicted around 2026 in the above chart does fit with the calculation earlier where I said:

This alternative scenario says that the end of step 3 down would end in the period 2023 to 2026.

This calculation is verified by the above chart within reasonable limits of error.

The conclusion I draw from this is that if we don’t begin a bear market by 2015 that takes us down reasonably close to the 2009 lows, there is likely not going to be a catastrophic step 3.

A low during the 2023-2026 time period should be unrelated to step 1 down in 2003 and step 2 down in 2009. The spread in time is too great to make a reasonable connection between the three dates. For a final definitive answer to this, I think we should wait 10 years.

I have mentioned a couple of times that I was intrigued with what could take place after we finished 3rd step up since 2009. I had thought it was possible a mini-bear market that carries the Dow Industrials back to the lows seen in October 2011 could be a reasonable possibility. From there we could launch another new up leg to the bull market that began in 2009.

EDSON GOULD

Edson Gould never made reference to cycles. He did write briefly about music and octaves. (Whoosh . . . right over my head at the time, but I kept that section of “Findings & Forecasts” because I thought he was stating more than the obvious.) He drew no direct practical relationship to musical octaves and the stock market. But if one thinks about octaves, it can lead to harmonics and cycles. Octaves also show us how cycles can reside within cycles. From there it’s an easy jump to the stock market.

Gould’s reference to music is a excellent example of how one had to read between the lines to find the true meaning. Gould’s simpler concepts were out front and easy for everyone to see. But I’ve always believed that his more difficult and highly prized secrets were kept closer to the vest. Why did I believe this?? Too often I would say, how did he do that???

The knowledge that he accumulated throughout his life wasn’t given away in an obvious manner. He made you work to figure out what was going on behind the curtain of the Great Oz.

It became my belief that cycles exist, they occur in varying lengths, and that cycles occur within other cycles. The accumulation of all cycles into one cumulative cycle is what pulls the stock market into its primary trend. The shorter cycles are less powerful and exert a small influence. Conversely, long cycles are more powerful and exert a strong influence on the stock market.

The cyclic periods were different lengths prior to the great depression and WW II. It seems the awaking powers of the FED during WW II and the early years of the Roosevelt presidency created different cycle lengths. Prior to the depression, government manipulation of the economy was not the factor that it has become since the depression. Today the government will throw every available tool at the economy to avoid a repeat of the great depression. Witness 2008 and onward where the FED has been dropping money from helicopters (reference next paragraph).

In 2002, following coverage of concerns about deflation in the business news, Bernanke gave a speech about the topic. In that speech, he mentioned that the government in a fiat money system owns the physical means of creating money. Control of the money supply implies that the government can always avoid deflation by simply issuing more money. He said “The U.S. government has a technology, called a printing press (or today, its electronic equivalent), that allows it to produce as many U.S. dollars as it wishes at no cost.”

He referred to a statement made by Milton Friedman about using a “helicopter drop” of money into the economy to fight deflation. Bernanke’s critics have since referred to him as “Helicopter Ben” or to his “helicopter printing press.” In a footnote to his speech, Bernanke noted that “people know that inflation erodes the real value of the government’s debt and, therefore, that it is in the interest of the government to create some inflation.”

Helicopter drop – A liquidity trap is a situation described in Keynesian economics in which injections of cash into the private banking system by a central bank fail to lower interest rates and hence fail to stimulate economic growth. A liquidity trap is caused when people hoard cash because they expect an adverse event such as deflation, insufficient aggregate demand or war. Signature characteristics of a liquidity trap are short-term interest rates that are near zero and fluctuations in the monetary base that fail to translate into fluctuations in general price levels

FED, NATIONAL DEBT & INFLATION

Inflation diminishes the value of the government debt. The trillion dollars that we borrowed in 2008 will be worth far less in 20 years and be less burdensome in tomorrow’s dollars due to inflation. This statement is only true if government receipts from taxes continues to grow with an expanding economy. Lower receipts in 20 years would be highly deflationary and the trillion dollars borrowed in 2008 would be valued far greater in 20 years.